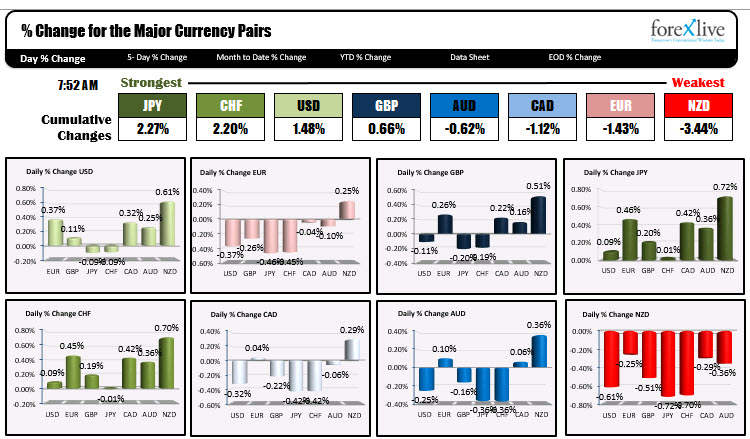

The USD is rebounding modestly today

In other markets

- Spot gold is trading down $-13.18 or -0.68% of $1929. Silver today is trading down over $1.09 or 4.45% at $23.50 as it loses some of its shine after the 7% gain yesterday

- WTI crude oil futures are trading down $0.13 or -0.3% $41.47

In the premarket for US stocks the major indices are trading lower after each of the indices close higher yesterday (S&P up 23.70 points, NASDAQ up 173 points, Dow industrial average up 114.88 points):

- Dow is down down -121 points

- S&P index is down -11.41 points

- NASDAQ index is down -40.6 points

In the European equity markets the major indices also lower (the Spain Ibex is the exception with a modest gain currently):

- German DAX, -0.41%

- France's CAC, -0.74%

- UK's FTSE 100, -0.11%

- Spain's Ibex, +0.15%

- Italy's FTSE MIB, -1.45%

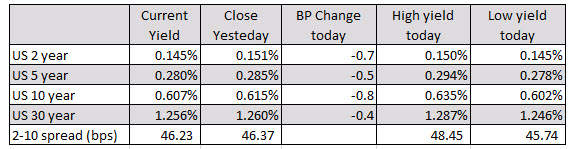

In the US debt market yields are down marginally. The 2 – 10 year spread is near unchanged levels

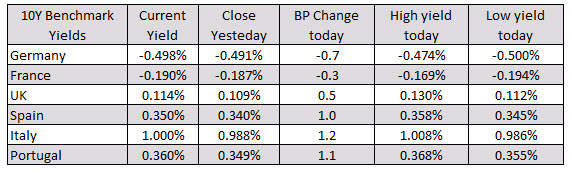

In the European debt market, the benchmark 10 year yields are mixed with Germany, France marginally lower. Yields in the UK, Spain, Italy and Portugal and Italy are marginally higher.

Reprinted from forexlive, the copyright all reserved by the original author.

Tuyên bố miễn trừ trách nhiệm: Quan điểm được trình bày hoàn toàn là của tác giả và không đại diện cho quan điểm chính thức của Followme. Followme không chịu trách nhiệm về tính chính xác, đầy đủ hoặc độ tin cậy của thông tin được cung cấp và không chịu trách nhiệm cho bất kỳ hành động nào được thực hiện dựa trên nội dung, trừ khi được nêu rõ bằng văn bản.

Tải thất bại ()