I was a banker , initially , my job was in operations and i was very afraid of financial markets like stocks , mutual funds and other assets. The word investment was the only thing i knew was safe and easy .Money was not very much important in my life. Had an easy going life , my pay scale was INR 15000 per month ($206). Then something happened in my life , its personal and if i say what happened , people from Hollywood will make movie on my life. So don't wanna go deep.

I went into depression , left my job. Did nothing for whole one year. After that I started to find where can i make a lot money. I choose Stock market and when totally new to this field as was never part of it , it was very different world for me. For the first time saw and got to know the Japanese candlesticks and the live streaming prices of stocks on screen. It was like opening eyes in totally different world.

My goal was clear , i had to be in market. But life purpose was to be on top. So decided to to step in. I opened a trading account with one broker bank. And the relationship manager , guided me that they will provide research calls for trades. So was little happy , but the calls accuracy was not as per my initial expectations and i can rate 60%.I when realized that i am making more trades per day as research calls and SMS comes on my phone. Luckily i made INR 500 or $7 for the first day was happy about it. But when my transaction note came in evening , due to buy sell transaction costs , i was charged more then INR 1800 ($24) for trading transactions. So i learned the lesson , not trading most time when calls or reports comes , I knew i had to wait for the right profit of 5 to 10 dollars in one trade. So that i can have more money as profit after deduction of those fixed costs which i bear earlier.

So first wise step i learned was focusing on fixed costs that i will have to pay , whether i am in profit or loss. So this made me disciplined trader. Now i got second lesson that making money like this will have to put on daily basis this efforts. So i started trading daily from 9am to 3.15pm I was now a day trader. Soon i started getting success , as i followed some sites for research and some news which usually are on stock markets. So i started making nearly $10 averagely , happy about it , and one day a storm came and blow up my entire account. When i took position in a company stock , the price started to fall drastically. It was miserable , because i had 2000 shares and the price fall nearly 12 points and so loss was heavy for me. I stopped trading , and then had a thing that why the hell i did not went out when the price was falling. The emotions got me , that it will rise. So i again learned that market don't respect emotions. This was greed and fear type situation and was really bad. Then i got again with stock market , this time i knew there is some special orders like stop loss , profit target order. I was unaware about this before. So when i knew about this order types , i recall the situations that if i had made stop loss orders , i had not mess money with this.

Then started working on stocks , but as usual news , research calls don't work because market discounts every thing. There are many lessons ,i learned. Now i decided to work my own. So i took candle sticks as my base. I was now observing them and got to know how this works. Those green means profit and red means loss. This was my basic initial thought. I was not knowing the reason for those turning green or red , Then i understand the demand and supply of economics . So i started seeing the orders panel and observe weather buy orders are more or sell orders are more in live market. If there were more buy orders , candles formed were majority green and i enter at buy position and when sell orders are more , i opened sell position and my profit target was 0.50 points and i open two positions on different stocks and mostly i managed to come out with profits.

But very soon i started getting fed off. Because i knew i had to be in one of top. So i started with more learning. In moring i didnot trade , had less money. So i started to spend day in Motor garage , where i learned new things about cars and how to open them and work in it. So it was like a lesson time. At night i spend time on looking companies and their charts and prices and how those reacts on events. So this kept me active in markets along with other learnings.

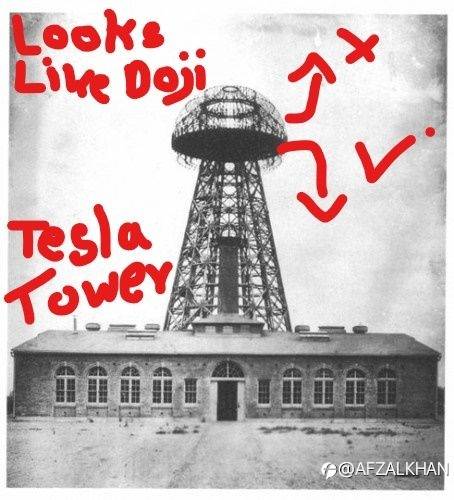

Now the day came , when i got a call from fraud research company , they offered me free tip in live market and i was lucky enough i had kept my eyes on chartings , the research guy told me to take position on a stock and told me the price will more 10 points or $10 from current price. I saw chart while talking and saw a pattern called doji on top and i said , man why do you think the price will move bullish. He told , my research head has given call , i asked him can i speak with him , usually research heads don't talk with people directly , but as this was fraud company he handed call to one guy who told me i am research head , so i asked him , why do you think the price will move 10- points from here in bullish direction? The guy told me, its good company , i again asked him , why as most companies are good then why do you think its gonna be bullish , the guy said , he has more knowledge and don't wanna argue. I asked him chart shows bearish pattern , he replied all are green , then i got this person doesn't know what are candle patterns and on contrary i gave him price will fall and the guy was surprised he asked me are you analyst? I said no , then the guy kept the phone. So there are many people who are fraudulent , saying and selling tips , calls and actually they don't have knowledge about the field.

So i started with mixed situations now , as i did not got what satisfy me on the trading research. Then i learned about planned diversification of investments , when i tired to average my losses on stocks. So basically found one method to observe the stocks , and when i see them running in bull run , i put my target of one day in that. So lets say a stock closes bullish for day1 and on day2 its near closing to bullish , i take position and close the trade on next trading day as soon as market opens. So i got in this habits. And it always works. Now the cards were with me. So i started like this and had many successful runs and i started making nearly $35 a day , which was very good amount as compared to my country average income.

I was feeling like king of market and when you are over confident enough , market will throw you down to hell. And i also got in such situation , when my positions on both the company , were opened in negative and had losses . So i learned another lesson as not to be over confident and i started to search the reason for the fall and got that due to global markets global markets rallying in bearish , its impact was on this stocks too as the indices did fall with.

So now i thought that i need a precise plan to trade and make money with discipline. So first step i do is check global markets in morning and react accordingly. If global markets are opened in positive , i play bullish on stocks and if bearish i play accordingly.

But over and above , i knew there is some sort of magic as most people do trades on buy or sell side daily. The analysis and i got deepen in that. I learned analysis own my own and the learning experience is really crazy.

My source of inspiration were many people who indirectly helped me. Nikola Tesla - The scientist , Jesse Livermore- The greatest trade ever lived - whose method i cracked to know the markets.

Now i turned myself from trader to trade analyzer. Trading and also analyzing stocks and their future movements like pro.

Now came a day when i got hit of stock market crash before 20 days. It so happened , while observing an indices , i felt a pattern coming and i stopped my positions on bull side and sit out from trading markets. I predicted market crash two times and it did got crashed. So i knew i had something now which is more then just a method to analyze the stocks.

So now indices started catching my mind and now i got to know big moves.

So i slowly started my ways and put my plan to action. I selected 3 stocks and had made some investment and the growth i started getting was $65 a day. Sometimes its $45 , $30 , $69 etc. So i did not had to do any thing, i just woke up every day , check my portfolio and every time its in profits. I now got a feeling like bull , but one day due to personal emergency needs , had to withdrew entire investment and had to leave that move. And those companies gave massive results for two continuous years. Stock price never went , down till where i started and kept rising. So i again learned a very big lesson , don't cut the tree , that gives you more fruits daily. So keep things ready and prepare an emergency fund.

The i got very deep with technical as i did not have enough funds to invest meeting emergency needs. So for continuous participation in market , i always tried to analyze the stocks and their moves and like this i have developed some methods , which are more reliable and accurate to get good results.

I worked in forex markets ,and also have good results too. In forex , i got what i loved most , the volatility and a source to make hell of money.

So my journey in trading was fill up with ups and downs , but that made me more perfect with analysis of forex , stocks , indices , cryptos.

Recently i was the person , who predicted big move from 30k in BTC/USD , and we all know BTC/USD crossed more then 50k at that time. Secondly some companies stocks which also gave expected results , some forex pairs etc.

Today most of my predictions works well enough thanks to Mr Tesla and Mr Livermore, my inspirations.

Before knowing a doji candle , i used to see Tesla tower on charts for bearish move , as towers head is on top and people always fall down from tower when jump rather , then flying to sky.

Mr Livermore's methods are also good enough unless you know the hidden patch to apply on chart.

My achievements are many , but don't want to flatter it. check my past posts , people you will know me. My dream. Now a days besides trading , i am thinking to join an investment or trading company as i am best in this field. Looking for international career in good company.

SOME IMPORTANT LESSONS I LEARNED

- Always respect the market

- Follow the trend

- Market is not for emotional fools

- Greed and fear will always be with you , choose wisely

- Have a strategy for trading

- Always have a strict stop loss

- Always limit costs or brokerages charges

- Never trade on News or Events

- Have some knowledge before trading in real markets

- Always have a look on global trend first

- Always analyze your trades which are in loss . try to find out why?

- Keep buy sell order tabs info always open to know the weight of either side.

- Choose a genuine source to follow for trade

- Try to work little hard , one day you will be smart.

- In stocks or forex , the volatility is main factor of market.

- When there is an uncertain big green candle or big red candle , always think that a big player or asset firm or investment firm , big banks are in or out of market.

#mytradingstory##FollowmeFanFestival#

Thanks

Afzalkhan Pathan

A man who knows the future of stocks , indices , forex etc

Đã chỉnh sửa 04 Sep 2021, 15:26

Tuyên bố miễn trừ trách nhiệm: Nội dung trên chỉ thể hiện quan điểm của tác giả hoặc khách mời. Nó không đại diện cho bất kỳ quan điểm hoặc vị trí nào của FOLLOWME và không có nghĩa là FOLLOWME đồng ý với tuyên bố hoặc mô tả của nó, cũng không cấu thành bất kỳ lời khuyên đầu tư nào. Đối với tất cả các hành động do khách truy cập thực hiện dựa trên thông tin do cộng đồng FOLLOWME cung cấp, cộng đồng không chịu bất kỳ hình thức trách nhiệm pháp lý nào trừ khi được cam kết bằng văn bản.

Trang web cộng đồng giao dịch FOLLOWME: www.followme.asia

Tải thất bại ()