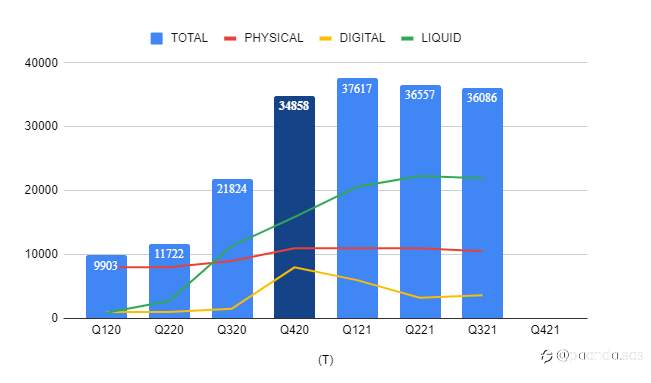

Assets under Management

Total (EUR): 36 086

Valuation per Segment

Physical assets: 10 500

Digital assets: 3 635

Liquid assets: 21 951

Growth (AuM)

Total (EUR): 26 186

Q3/21 (EUR): - 471

Download the full trading history (FX, CFDs only)

Risk Functions

Invests no more than 150% of the principal.

Value at Risk (Var) on open positions average 2%.

Global Strategy

Macro with focus on demographic and capital flow events

The current main view and scenario is:

- inflationary risks in the US (2nd wave)

- slow and steady - but consistent - inflation trend in Europe

- the shift in economic power and leadership from West to East

In the Markets

We still play:

- USD to extend gains to 95, then resume downtrend to 90/85

- US markets to remain stable, with an upside risk

- EUR markets to remain stable, with a downside risk

- ASIAN markets to remain volatile but stable, in consolidation of 2020 growth

- COMMODITIES gradually trading higher

Notes from the desk

This quarter:

- Energies spiked up,

- Talibans back to power in Afghanistan,

- The market also currently focus on the Evergrande case. Upcoming coupons to be paid...

In the coming quarters, a strong alliance could emerge from the East...

We will try to detail the analysis in a blog post later.

On Indices,

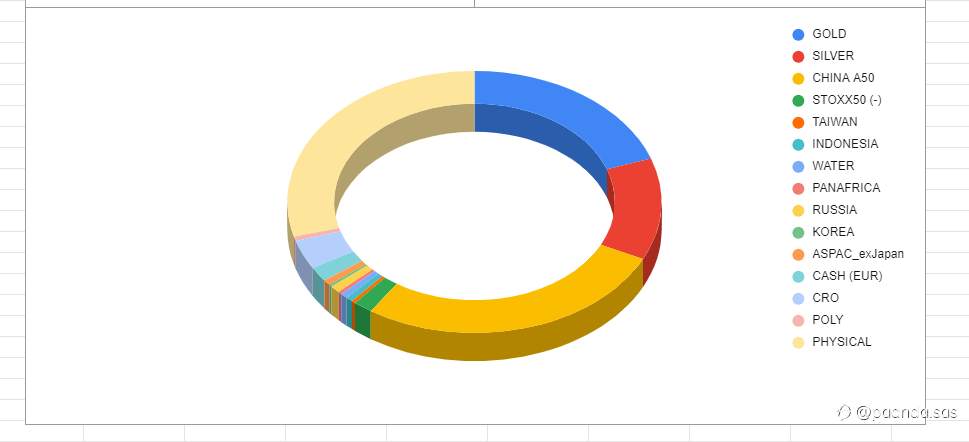

We have bought some more China A50 to complete our position, accordingly to the plan, between 14K and 15.5K support zone. Also, we have started to enlarge our exposure through all around Eastern region, and a bit of Africa - using Lyxor ETFs.

ISIN: FR0010527275 LU1900065811 LU1900066033 LU1287022708 FR0011869387 FR0011869338 FR0011869312

On Metals,

Long only, with a reasonable exposure, ready to build up more size if momentum is ok.

On USD,

We were waiting for that spike above 93. to reach 95... here we are!

Critical pivot, where we will soon know more about the coming steps.

On Cryptos,

Sold all tokens on 18th September...

Except CRO - and a small amount of POLY (250) we got from an airdrop in 2017.

We are not going to increase size in this segment.

Statistics

Future Will Tell...

#OPINIONLEADER# #CHINA-A50# #AsianMarket# #XAU/USD# #USDollarIndex#

Đã chỉnh sửa 05 Oct 2021, 05:39

Tuyên bố miễn trừ trách nhiệm: Quan điểm được trình bày hoàn toàn là của tác giả và không đại diện cho quan điểm chính thức của Followme. Followme không chịu trách nhiệm về tính chính xác, đầy đủ hoặc độ tin cậy của thông tin được cung cấp và không chịu trách nhiệm cho bất kỳ hành động nào được thực hiện dựa trên nội dung, trừ khi được nêu rõ bằng văn bản.

Để lại tin nhắn của bạn ngay bây giờ