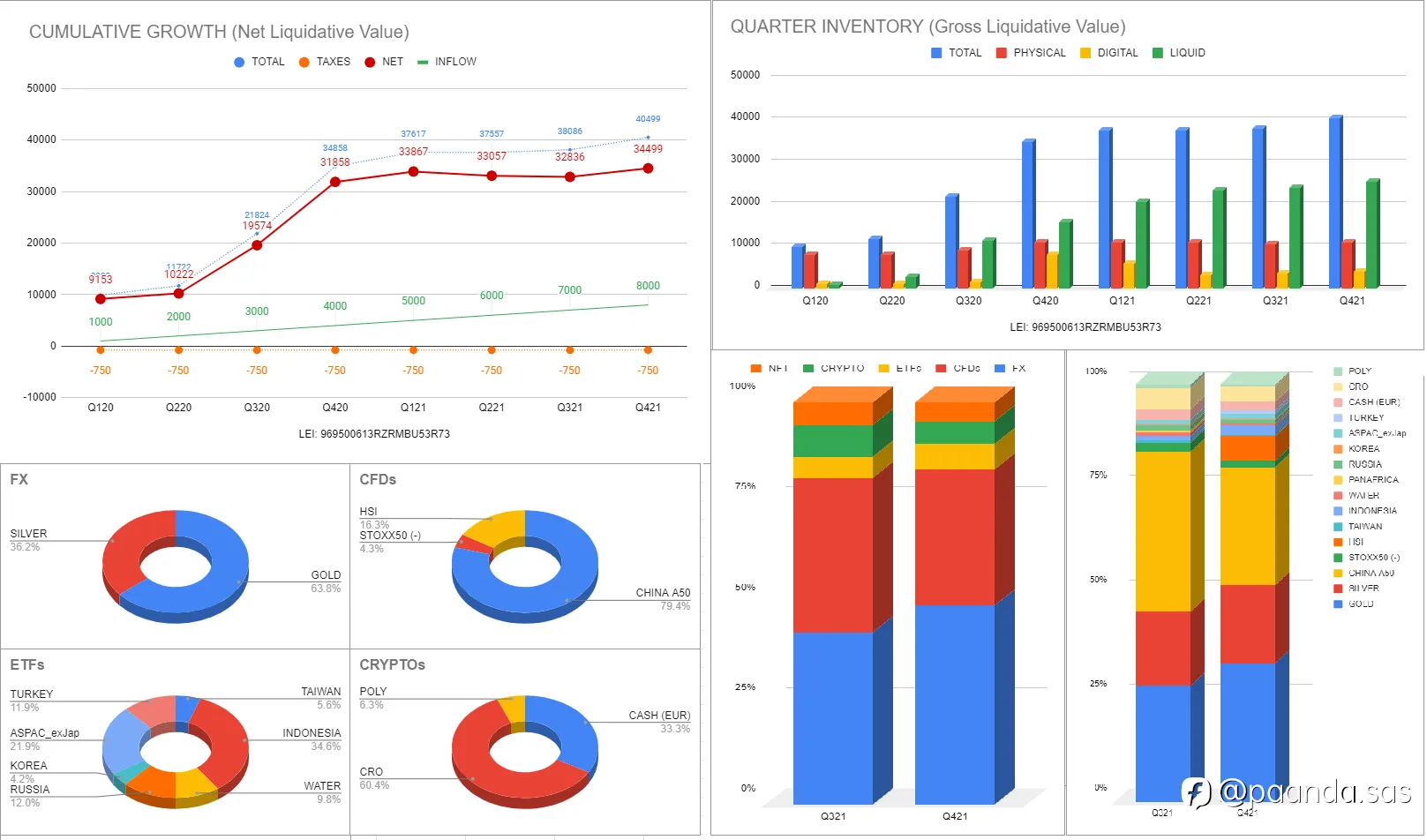

Assets under Management

Total (EUR): 34 499

Valuation per Segment

Physical assets: 11 000

Digital assets: 4 100

Liquid assets: 25 399

Witdrawal / Taxes: -6 000

Growth (AuM)

Total (EUR): 27 849

Q4/21 (EUR): + 1 663

-------------------------------------------------------------------------------------

Risk Functions

Invests no more than 150% of the principal.

Value at Risk (VaR) on open positions average 2%.

Global Strategy

Macro with focus on demographic and capital flow events

The current main view and scenario is:

- inflationary risks in the US (2nd wave)

- slow and steady - but consistent - inflation trend in Europe

- the shift in economic power and leadership from West to East

In the Markets

We play:

- USD to stay on a flat line, then resume downtrend toward 93/90.0

- US markets to remain stable, with an upside risk

- EUR markets to remain stable, with a downside risk

- ASIAN markets to gain traction

- COMMODITIES (ex. energy) gradually trading higher

Notes from the desk

This quarter:

- Energies have followed their path to the moon- should be on a top now

- US and EU finally admitted that inflation is not that "transitory".... 35% of dollars in circulation were printed in 2021, to give an idea.

- China is currently paying the price for their short-term adjustment, regulations, restrictions etc... to stabilize and normalize its markets. Take it as a good news for the next quarters, as, combined with: 1. law about 3 children, 2. government probably going to push that way (by easing labor conditions, giving more holidays, providing a more attractive environment to raise 3 children as a whole), will solve most of the problems related to current demographic vs. size and strength of economic growth. In one sentence, apart for the necessary structural adjustments, the big success of China in the future is mostly tied to a demographic challenge - we believe...

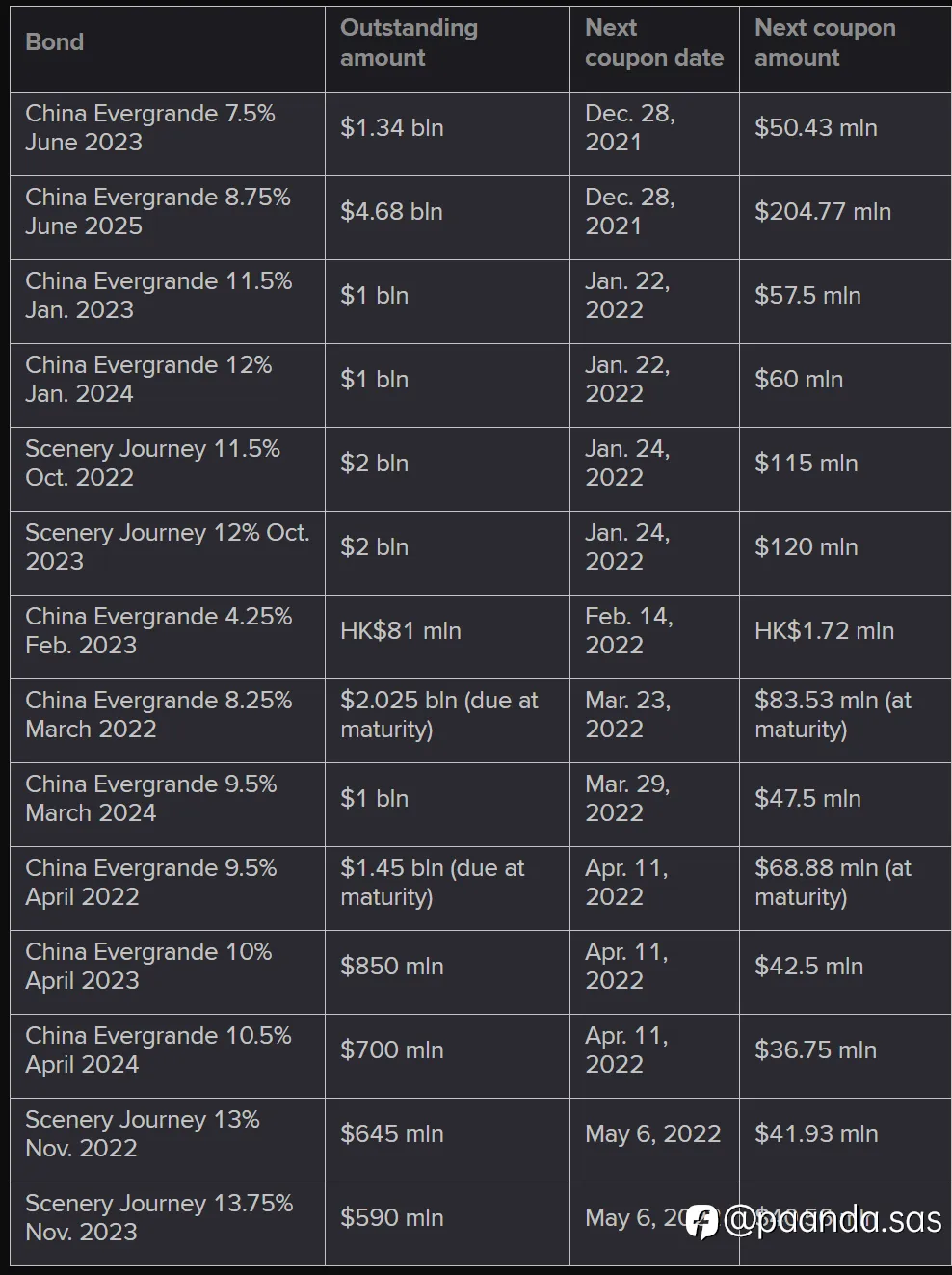

- Evergrande case. Upcoming coupons to be paid...

On Indices,

We now are well diversified across different indices and regions.

Added some HSI (Hong Kong) in our Porftolio.

Added exposure to Indonesia via an ETF

On Metals,

ready to build up more size if momentum is ok,

or get out temporarily if USD trades >97.

On USD, he situation remains unchanged.

On Cryptos, sold 70% of our CRO,

Please see the relevant article here: https://www.followme.cn/c/2203...

Below is a summary of our position in book on 3rd of January 2022

Statistics and Exposure: download details here

Future Will Tell...

Happy New Year!!!

#OPINIONLEADER# #CHINA-A50# #AsianMarket# #XAU/USD# #USDollarIndex#

Đã chỉnh sửa 04 Jan 2022, 21:24

Tuyên bố miễn trừ trách nhiệm: Quan điểm được trình bày hoàn toàn là của tác giả và không đại diện cho quan điểm chính thức của Followme. Followme không chịu trách nhiệm về tính chính xác, đầy đủ hoặc độ tin cậy của thông tin được cung cấp và không chịu trách nhiệm cho bất kỳ hành động nào được thực hiện dựa trên nội dung, trừ khi được nêu rõ bằng văn bản.

Để lại tin nhắn của bạn ngay bây giờ