EURUSD is accelerating its advance above 1.0200 on the latest Reuters report that ECB policymakers are set to discuss a rate hike worth 25 bps or 50 bps at Thursday’s meeting. The US dollar resumes its corrective downside. Eurozone inflation awaited.

EURUSD Price has carved out a bear flag formation on the daily sticks, in the wake of the ongoing consolidative mode that followed the downtrend. The rising trendline resistance at 1.0224 is the line in the sand for EUR sellers. But first, the bulls will need to find acceptance above 1.0200.

On the downside, the rising trendline support at 1.0050 could limit any fresh declines, below which the parity will get challenged once again.

The 14-day Relative Strength Index (RSI) is turning south again while within the bearish territory, suggesting that a fresh downswing could be in the offing. A breach of the abovementioned 1.0050 support on a daily closing basis will confirm a bear flag, reopening doors for a new twenty-year low below 0.9952.

The policy divergence between the Fed and the ECB remains one of the key factors undermining the euro. The contrast is only likely to widen further this Thursday when the ECB delivers on its pre-committed 25 bps rate hike, the first lift-off in 11 years. The Fed is set to increase the key rates by 75 bps next week, as it remains committed to fighting inflation head-on.

The European Union (EU) and China will hold a high-level economic and trade dialogue on Tuesday amidst tensions over a number of issues including the war in Ukraine, Xinjiang and an as yet unratified investment agreement, per Reuters. "I look forward to co-chairing this important event together with China Vice-Premier Liu He,” Executive Vice President of the EU Commission, Valdis Dombrovskis tweeted out on Monday.

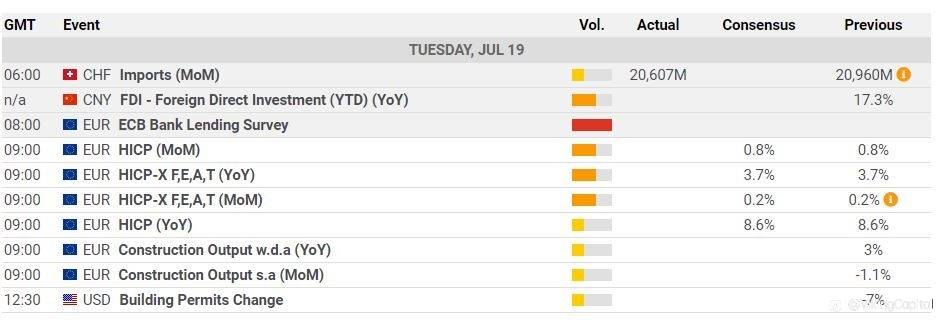

Eurozone final HICP (inflation) will be reported at 0900 GMT this Tuesday. The final revision will confirm the record high Eurozone inflation rate at 8.6% in June. Besides, the US will report the Building Permits and Housing Starts data for June.

Tuyên bố miễn trừ trách nhiệm: Quan điểm được trình bày hoàn toàn là của tác giả và không đại diện cho quan điểm chính thức của Followme. Followme không chịu trách nhiệm về tính chính xác, đầy đủ hoặc độ tin cậy của thông tin được cung cấp và không chịu trách nhiệm cho bất kỳ hành động nào được thực hiện dựa trên nội dung, trừ khi được nêu rõ bằng văn bản.

Tải thất bại ()