The US economy is showing resilience, especially in the services sector. The US consumer sentiment is optimistic, being supported by wage gains and falling inflation expectations. The core PCE is at 4.6 percent which is above the 2 percent FED target. Canada's inflation is falling faster than the US inflation currently at 3.2 percent which is relatively close to BOC 2 percent target.

Interest rate differential

The FED is expected to hike rates in September and November each by 25 basis points pushing the fed fund rates to the range of 5.5-5.75 percent while Canada's rates are expected to have peaked. Canada's inflation rates are close to target meaning BOC could be the first to cut rates.

The interest rate differential between US and Canadian bond yields has been growing in favor of the dollar it the large part of the week while USDCAD has been falling. That divergence will be reflected in the currency.

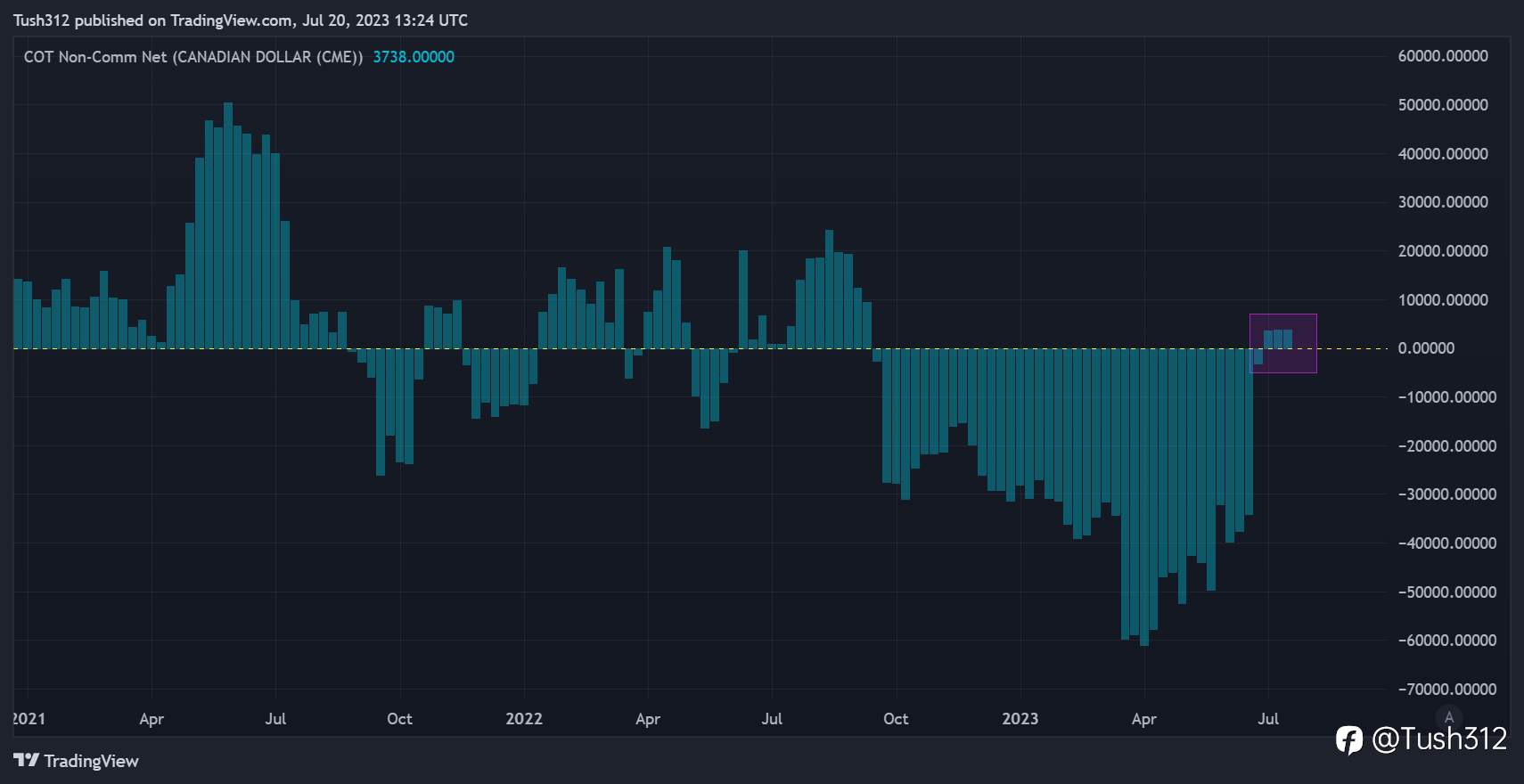

Positioning and Sentiment

Leveraged funds bets on CAD is slightly bullish which can easily flip to bearish wagers as CAD weakens further.

Price action

Fundamentals tell us what will happen in the future then price tells us when that will happen. Any price structure that supports bullish direction of the currency close to 1.300 might present a good buy opportunity.

Tuyên bố miễn trừ trách nhiệm: Quan điểm được trình bày hoàn toàn là của tác giả và không đại diện cho quan điểm chính thức của Followme. Followme không chịu trách nhiệm về tính chính xác, đầy đủ hoặc độ tin cậy của thông tin được cung cấp và không chịu trách nhiệm cho bất kỳ hành động nào được thực hiện dựa trên nội dung, trừ khi được nêu rõ bằng văn bản.

Để lại tin nhắn của bạn ngay bây giờ