We've conducted an in- depth review of eToro and Interactive Brokers to determine which bone presents the better overall choice and which dealers will profit the most at either broker.

Introduction

eToro offers 25M social dealers its popular personal CopyTrader and CopyPortfolios services and maintains in- house managed thematic investment portfolios. It caters exceptionally well to its core dealer base, and its rearmost adventure is an NFT fund following multitudinous accessions in the cryptocurrency sector. The eToro Academy, eToro plus, and The Bull Club help freshman dealers.

Interactive Brokers presents one of the most competitive core trading surroundings available encyclopedically, with a suite of slice- edge personal results developed for advanced dealers. It supports third- party inventors and algorithmic trading results. freshman dealers will profit from the comprehensive IBKR Lot, one of the highest- quality educational services assiduity-wide.

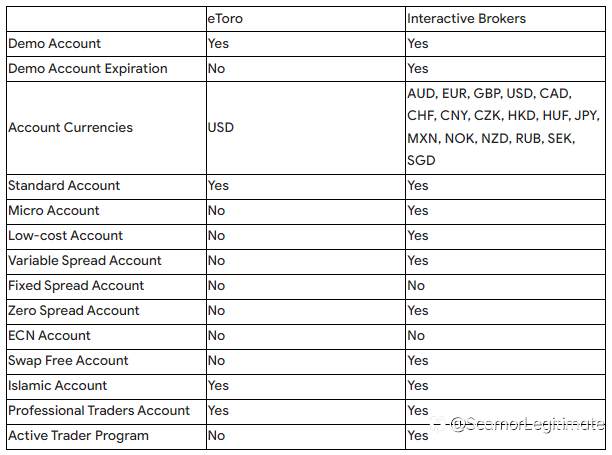

Account Types

Features

eToro is a well- known worldwide fintech incipiency and the leader in the social trading field( following other people’s trades), with over 30 million druggies worldwide.

You can also invest in other products through their platform, which is intuitive and simple to use, making it a good choice for newcomers. Plus, eToro offers commission-free stock trading.

Opening an account and depositing is easy, and you can indeed try it out with virtual plutocrat( a rally account). On the strike, spreads can be high for some products.

Interactive Brokers is a global online broker and intimately listed company which surpassed major fiscal heads, showing adaptability and a rigorous threat operation process.

It offers an advanced investment platform that includes a wide range of products( stocks, options, collective finances, ETFs, futures, bonds, and currencies) from 150 requests.

Newcomers and intermediate investors have educational tools to explore, but the literacy wind will be steep. Interactive Brokers also launched IBKR GlobalTrader, a ultramodern mobile trading app to trade Stocks, Options and ETFs.

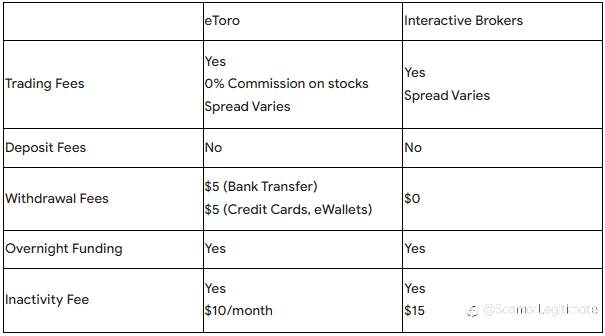

Fees and Pricing

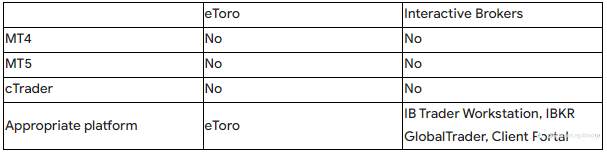

Trading Platforms

Regulation and Security

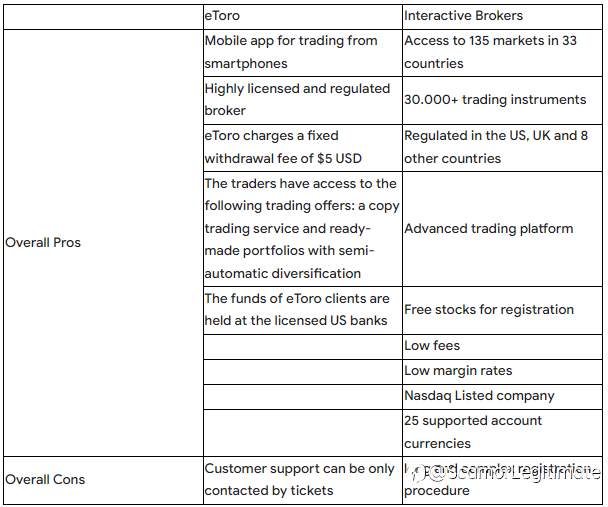

Pros and Cons

Conclusion

In conclusion, both eToro and Interactive Brokers are largely regulated and offer a wide range of trading means. eToro is the stylish player at offering dupe and social trading, while Interactive Brokers offers a wider range of base currencies and a lower spread on forex. Eventually, the choice between eToro and Interactive Brokers will depend on your individual requirements and preferences.

Tuyên bố miễn trừ trách nhiệm: Quan điểm được trình bày hoàn toàn là của tác giả và không đại diện cho quan điểm chính thức của Followme. Followme không chịu trách nhiệm về tính chính xác, đầy đủ hoặc độ tin cậy của thông tin được cung cấp và không chịu trách nhiệm cho bất kỳ hành động nào được thực hiện dựa trên nội dung, trừ khi được nêu rõ bằng văn bản.

Để lại tin nhắn của bạn ngay bây giờ