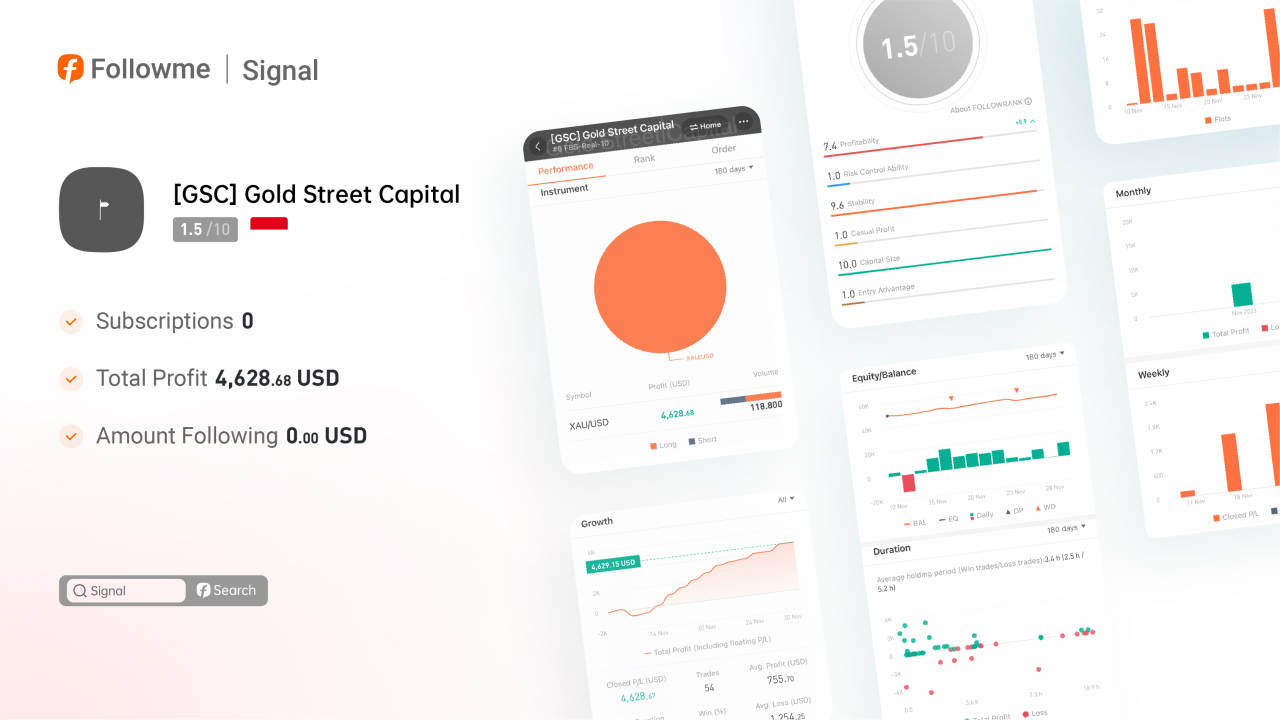

One rising trader, @[GSC] Gold Street Capital (ranked 31 by large account group), has been quietly generating impressive returns focusing solely on gold. While many traders still approach gold with buy-the-dip, sell-the-rip strategies, he generated $4,628 in profits over just two weeks alongside a maximum drawdown of only 1.50% - his smoothed equity curve looks like a gentle slide.

His order flow is also interesting - since November, he's deployed a balanced mix of buy and sell orders, doubling positions on confirmation as the signal dictates. This clearly resembles a Martingale hedging approach. However, gold's strong trending nature doesn't usually suit Martingale well.

Yet this trader seems to have a unique insight into applying trends effectively. He judges the direction, starting with 0.01 lots. On confirmation, he takes 20 pips before closing. On reversal with a $2 trend break, he opens 2 lots in the opposite direction, closing 30 pips in profit. And if the market whipsaws, reverting back to the initial trend? He scales in exponentially, opening 6 lots after a $4 trend.

At his maximum, he's had 4 consecutive positions open with a single 18-lot position, reaching a peak of 26.01 lots - around 50% allocation of his $50k account. The risk is high with no defined stops. However, he likely recognizes the risks beneath outwardly pleasant metrics, having already cashed out $3,605 in proceeds - securing profits for his own enjoyment.

Tuyên bố miễn trừ trách nhiệm: Quan điểm được trình bày hoàn toàn là của tác giả và không đại diện cho quan điểm chính thức của Followme. Followme không chịu trách nhiệm về tính chính xác, đầy đủ hoặc độ tin cậy của thông tin được cung cấp và không chịu trách nhiệm cho bất kỳ hành động nào được thực hiện dựa trên nội dung, trừ khi được nêu rõ bằng văn bản.

Tải thất bại ()