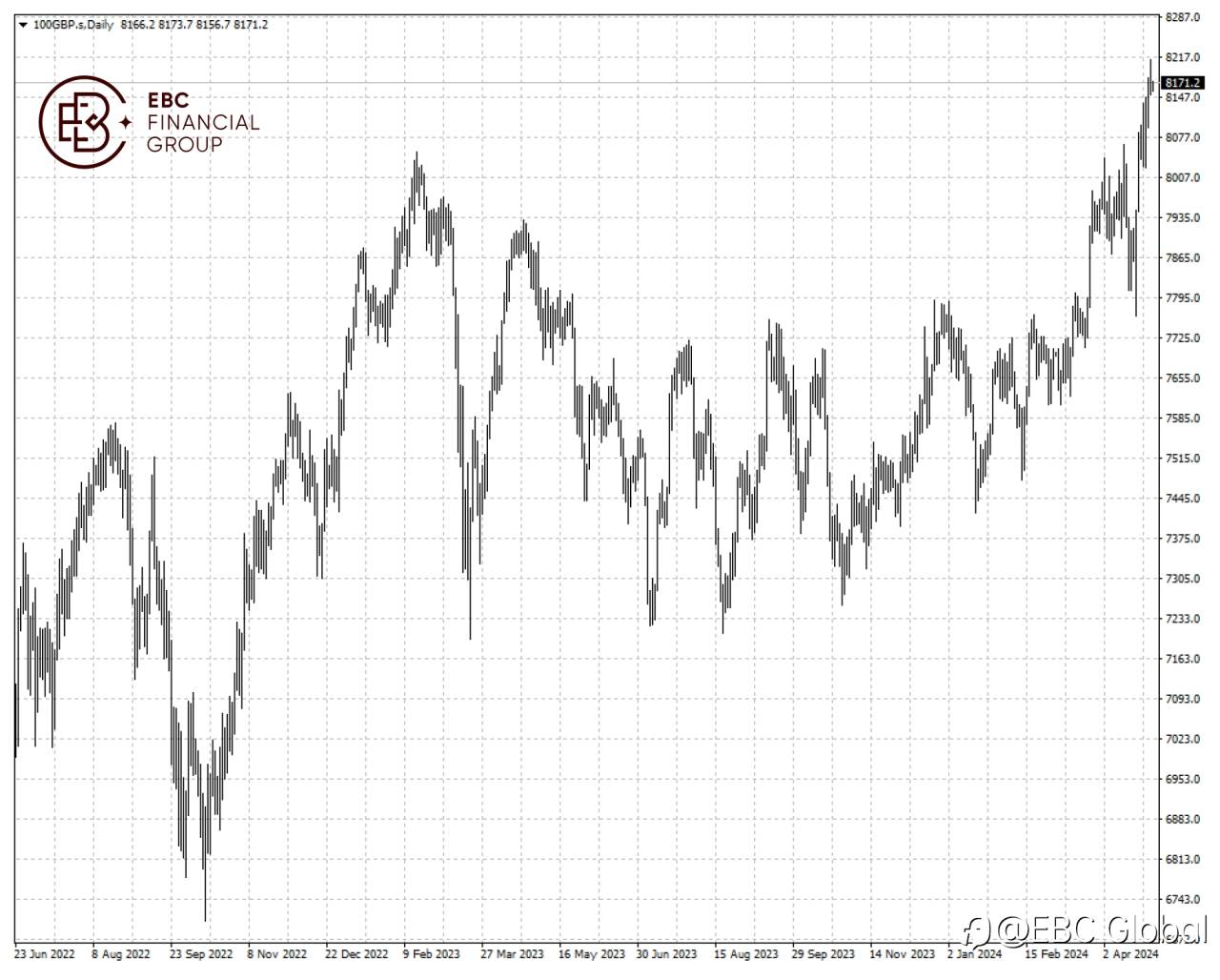

Asian stocks tracked Wall Street higher on Tuesday. The FTSE 100 extended its record rally for the fifth straight session on Monday, helped by positive corporate updates.

British stocks appear to have turned a corner after months of underperformance compared to their global peers as signs of inflation kept in check, and a recovering economy spurred confidence.

Businesses recorded their fastest growth in activity in nearly a year this month, thanks to a big rise in the services sector, which S&P Global Market Intelligence said points to accelerating economic expansion.

Anglo American gained 4% after a source familiar with the matter told Reuters that BHP Group was considering an improved offer after Anglo rejected a $39 billion proposal last week.

Energy stocks and basic material stocks are more prominent in the market than in the US, Germany or France’s, so the benchmark index has recently ridden the commodities wave to play catch-up.

World Bank said the sharp decline in commodity prices over the past two years had come to a halt, as geopolitical tensions tighten supplies and demand for industrial metals continues to grow.

The FTSE 100 has just set a fresh all-time high. Technical indicators signal further gains going forward and the next level to represent a major challenge may lie in the 8,200 area.

EBC Fintech Development Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation byEBC Fintech Development or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Tuyên bố miễn trừ trách nhiệm: Quan điểm được trình bày hoàn toàn là của tác giả và không đại diện cho quan điểm chính thức của Followme. Followme không chịu trách nhiệm về tính chính xác, đầy đủ hoặc độ tin cậy của thông tin được cung cấp và không chịu trách nhiệm cho bất kỳ hành động nào được thực hiện dựa trên nội dung, trừ khi được nêu rõ bằng văn bản.

Tải thất bại ()