Current trend

Prices for benchmark Brent Crude Oil are correcting in a poor upward trend just below 79.00 after a significant decline caused by concerns about the stability of demand for the asset.

Against this background, Saudi Arabia’s national oil company Saudi Aramco has reduced selling prices for July oil deliveries for buyers from Asia for the first time since February: according to Bloomberg, the cost of the Arab Light brand will be adjusted by 0.5 dollars per barrel and will be higher than the cost of Oman/Dubai by 2.4 dollars per barrel compared to the expected –0.4 dollars per barrel. This decision can be considered the first step in the implementation of the new OPEC plan, which provides for a gradual restoration of fuel production volumes from October 2024.

One of the key factors putting pressure on the quotes remains the US policy, which involves increasing the oil production and strategic reserves: according to the American Petroleum Institute (API), last week reserves increased by 4.052M barrels, which is confirmed by the report of the Energy Information Administration of the US Department of Energy (EIA), which reflected a correction of 1.233M barrels.

As for investment demand for oil contracts, it is actively recovering, as market participants fix profits from the fall of the asset and form new positions to buy at a low price. Thus, according to the Chicago Mercantile Exchange (CME Group), the volume of trading in oil futures since the beginning of the month has grown to 1.193M, while at the end of May, it was no more than 0.850–0.930M.

Support and resistance

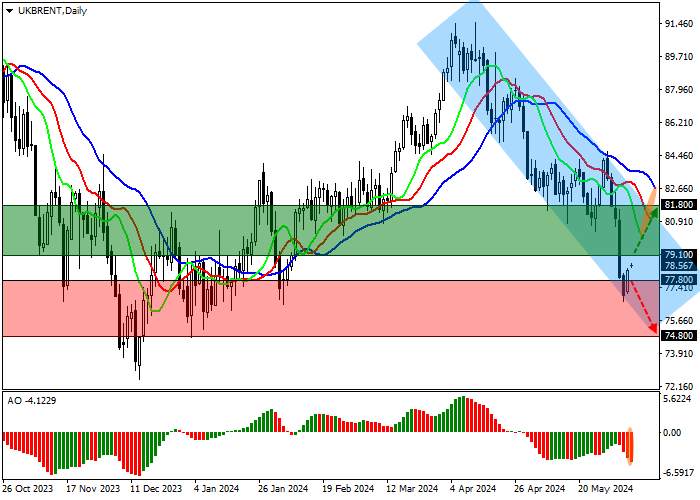

On the daily chart, the trading instrument is moving in a correction trend, reversing near the support line of the downward channel 81.00–78.00.

Technical indicators hold the sell signal: fast EMA of the Alligator indicator are below the signal line, and the AO histogram forms downward bars.

Support levels: 77.80, 74.80.

Resistance levels: 79.10, 81.80.

Trading tips

Long positions may be opened after the price consolidates above 79.10 again, with the target at 81.80. Stop loss is 78.00. Implementation period: 7 days or more.

Short positions may be opened after the price consolidates below 77.80, with the target at 74.80. Stop loss is 79.00.

Tải thất bại ()