Current trend

Despite the decline in the American dollar, the EUR/USD pair is holding on to a correction trend at 1.0800 and may continue to decline amid macroeconomic statistics.

In May, the German consumer price index rose by 0.1% MoM, in line with forecasts, and from 2.2% to 2.4% YoY. The indicator harmonized with EU standards increased from 2.4% to 2.8%. Last week, European Central Bank (ECB) officials decided to cut the interest rate by 25 basis points to 4.25%, and the acceleration in inflation may act as a catalyst for a return to a “hawkish” rate.

The American dollar is trading at 104.70 in USDX. Last week, the labor market strengthened, and May statistics reflected a slowdown in inflation from 3.4% to 3.3% YoY and from 0.3% to 0.0% MoM, while the core indicator adjusted from 3.6% to 3.4%, below estimates of 3.5%, allowing the market to hope for a transition to adjusting monetary parameters but yesterday, the US financial authorities decided to keep interest rates in the range of 5.25–5.50%, disappointing investors and putting pressure on the positions of the national currency.

In these conditions, a continuation of the decline in the EUR/USD pair looks like the most likely scenario.

Support and resistance

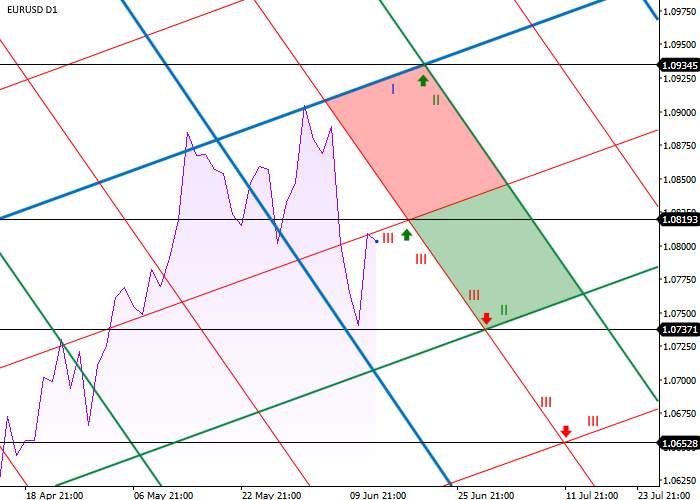

On the daily chart, the quotes are moving in the range between the first-order levels (I), having reached the left resistance level of the third-order (III) 1.0807 and preparing for another decline.

The most probable scenario is a reversal and continuation of the movement in a stable downward trend, with the target at the local crossroad of the right support of the second order (II) and the left support of the third order (III) 1.0737 and then at the crossroad of the left support of the third order (III) and the right support of the third order (III) 1.0652.

In case of a breakout of the third order (III), the quotes will continue to grow to the crossroad of the left resistance of the third order (III) and the right resistance of the third order (III) 1.0819 and then to the crossroad of the right resistance of the second order (II) and the left resistance of the first order (I) 1.0934.

Resistance levels: 1.0819, 1.0934.

Support levels: 1.0737, 1.0652.

Trading tips

Short positions may be opened after the consolidation below 1.0737, with the target at 1.0652. Stop loss is 1.0790. Implementation period: 7 days or more.

Long positions may be opened after the price consolidates above 1.0819, with the target at 1.0935. Stop loss is 1.0760.

Tải thất bại ()