| Scenario | |

|---|---|

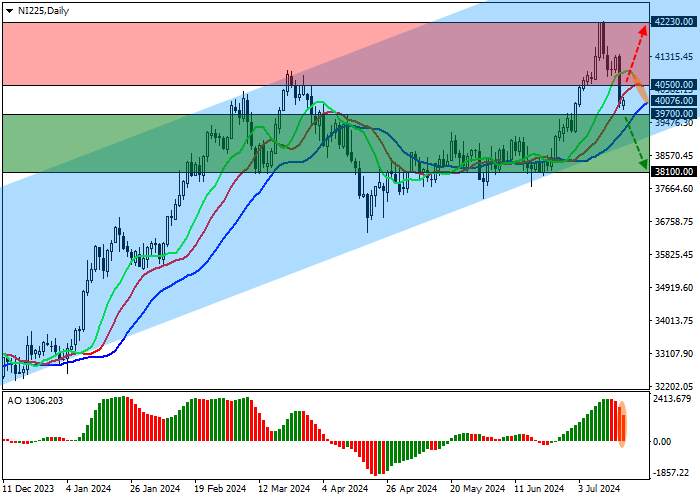

| Timeframe | Weekly |

| Recommendation | SELL STOP |

| Entry Point | 39700.0 |

| Take Profit | 38100.0 |

| Stop Loss | 40000.0 |

| Key Levels | 38100.0, 39700.0, 40500.0, 42230.0 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 40500.0 |

| Take Profit | 42230.0 |

| Stop Loss | 40000.0 |

| Key Levels | 38100.0, 39700.0, 40500.0, 42230.0 |

Current trend

The leading Japanese stock index NI 225 is correcting in a downward trend at the level of 40076.0 against the background of the continuing slowdown of the national economy.

Today, June foreign trade data was published, which confirmed a decrease in activity in both categories of trade turnover: Exports added 5.4%, below both the 6.4% expected by analysts and the 13.5% recorded in the previous month, while Imports increased 3.2%, falling short of the projected 9.3% and down from 9.5% a month earlier. The reduction in purchases had a positive impact on the trade balance, which amounted to 224.0 billion yen, higher than the deficit of 1.22 trillion yen last month.

Against the backdrop of ongoing problems in the economy and the gap in interest rates between the Bank of Japan and regulators of other developed countries, the bond market is showing unstable dynamics: 10-year debt securities fell to a yield of 1.057% compared to 1.072% last week, 20-year bonds — to 1.871% from 1.885%, and 30-year bonds — to 2.187% from 2.222%.

The growth leaders in the index are Nichirei Corp. ( 6.34%), Ajinomoto Co., Ltd. ( 3.33%), Kansai Electric Power Co., Inc. ( 3.28%), Asahi Group Holdings, Ltd. ( 3.27%).

Among the leaders of the decline are Tokyo Electron Ltd. (–8.86%), Dainippon Screen Mfg. Co., Ltd. (–8.34%), Hoya Corp. (–7.49%).

Support and resistance

On the daily chart, the price is approaching the support line of the ascending channel with dynamic boundaries of 44000.0–39000.0.

Technical indicators are preparing to continue weakening the previously received buy signal: the AO histogram is forming new descending bars, and fast EMAs on the Alligator indicator are approaching the signal line, narrowing the range of fluctuations.

Support levels: 39700.0, 38100.0.

Resistance levels: 40500.0, 42230.0.

Trading tips

If the asset reverses and continues declining, and the price consolidates below 39700.0, short positions can be opened with the target at 38100.0. Stop-loss — 40000.0. Implementation time: 7 days and more.

If the asset continues to grow and consolidates above the resistance level of 40500.0, buy positions with a target of 42230.0 will be relevant. Stop-loss — 40000.0.

Tuyên bố miễn trừ trách nhiệm: Nội dung trên chỉ đại diện cho quan điểm của tác giả hoặc khách mời. Nó không đại diện cho quan điểm hoặc lập trường của FOLLOWME và không có nghĩa là FOLLOWME đồng ý với tuyên bố hoặc mô tả của họ, cũng không cấu thành bất kỳ lời khuyên đầu tư nào. Đối với tất cả các hành động do khách truy cập thực hiện dựa trên thông tin do cộng đồng FOLLOWME cung cấp, cộng đồng không chịu bất kỳ hình thức trách nhiệm nào trừ khi có cam kết rõ ràng bằng văn bản.

Website Cộng đồng Giao Dịch FOLLOWME: www.followme.asia

Tải thất bại ()