Current trend

The leading index of the London Stock Exchange FTSE 100 is showing upward dynamics at 8316.0, which is largely due to a new correction in the bond market.

Despite weak corporate reports from index component companies, the instrument's quotes are stable. The revenue of the industrial group Air Liquide SA amounted to 6.73 billion euros, falling short of the 6.78 billion euros predicted by analysts, and the profit per share amounted to 2.86 euros, meeting expectations. Bank NatWest Group Plc. managed to show more positive results and become the leader in growth, recording an increase in revenue to 3.66 billion pounds from 3.48 billion pounds in the previous quarter, while earnings per share increased to 0.137 pounds from 1.104 pounds. In turn, the revenue of the telecommunications company BT Group Plc. amounted to 5.05 billion pounds, while experts expected 5.10 billion pounds, and the profit per share was 0.0383 pounds, which coincided with the forecast, but was lower than 0.0474 pounds recorded a year earlier.

Yields across the entire range of debt instruments began to decline again, with the rate on 10-year UK bonds falling to 4.103% from 4.169%, 20-year bonds to 4.582% from 4.618%, and 30-year bonds to 4.660% from 4.674%.

The growth leaders in the index are NatWest Group Plc. ( 7.04%), Anglo American Plc. ( 5.08%), Intertek Group Plc. ( 4.26%), Burberry Group Plc. ( 4.18%).

Among the leaders of the decline are Segro Group Plc. (–1.68%), Rightmove Plc. (–1.41%), Pershing Square Holdings Ltd. (–1.20%).

Support and resistance

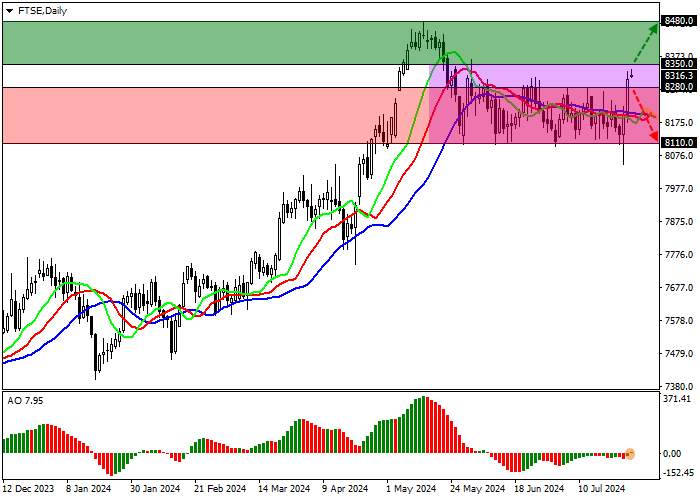

On the daily chart, the index quotes are correcting, holding slightly below the support line of the side channel with boundaries of 8350.0–8110.0.

Technical indicators are in a state of uncertainty and are getting ready to issue a new buy signal: the EMA fluctuation range on the Alligator indicator remains quite narrow, and the AO histogram forms new corrective bars, reversing towards growth.

Support levels: 8280.0, 8110.0.

Resistance levels: 8350.0, 8480.0.

Trading tips

If the index continues growing, and the price consolidates above the resistance at 8350.0, long positions with a target of 8480.0 and stop-loss of 8300.0 will be relevant. Implementation time: 7 days and more.

If the asset reverses and continues declining, and the price consolidates below 8280.0, short positions can be opened with the target at 8110.0. Stop-loss — 8350.0.

Tải thất bại ()