Current trend

The price of North American WTI Crude Oil is adjusting in an uptrend at 78.00.

Increased tensions in the Middle East have once again caused the volatility of quotations to increase. According to The New York Times, Iran's supreme leader Ali Khamenei ordered his subordinates to strike at Israel in response to the assassination of the head of the political bureau of the Palestinian Hamas movement in Tehran. Investors fear that Iran's direct involvement in the conflict could significantly reduce the volume of cheap oil supplied to the market, which will lead to higher prices.

According to a report published on Tuesday by the American Petroleum Institute (API), inventories decreased for the fifth time in a row, this time by 4.495 million barrels compared to a decrease of 3.900 million barrels a week earlier. On Wednesday, the Energy Information Administration of the U.S. Department of Energy (EIA) also published its data, recording a decline in reserves by 3.436 million barrels after a drop of 3.741 million earlier. The agency noted that the downtrend has also continued for five consecutive weeks, and the total volume of decline has already exceeded 28.0 million barrels.

According to the Chicago Mercantile Exchange (CME), the volume of trading in futures for WTI Crude Oil has increased over the past 3 days and amounted to over 1.0 million contracts, while at the end of last week the average figure was about 890.0 thousand positions, which also confirms the price increase.

Support and resistance

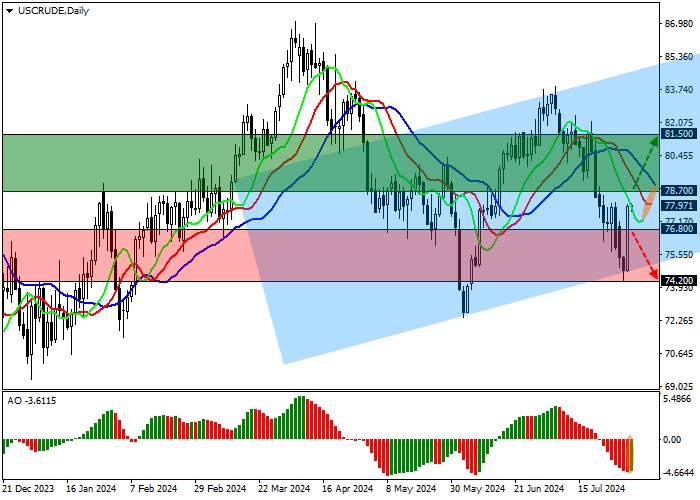

On the D1 chart, the price began to move away from the support line of the ascending channel with the boundaries of 85.00–74.00 and is now forming a new growth wave.

Technical indicators hold the sell signal, which has begun to weaken: the fast EMAs on the Alligator indicator are above the signal line and narrow the range of fluctuations, while AO histogram forms new correction bars, rising again in the purchase zone.

Support levels: 76.80, 74.20.

Resistance levels: 78.70, 81.50.

Trading tips

If the growth of the asset continues and the price consolidates above the resistance level of 78.70, one may open long positions with the target of 81.50 and stop-loss of 78.00. Implementation period: 7 days and more.

In case of a reversal and continuation of the local decline of the asset, as well as price consolidation below the support level of 76.80, one can open short positions with the target of 74.20 and stop-loss of 78.00.

Tải thất bại ()