Current trend

The GBP/USD pair has been falling for the third week in a row, and today the quotes reached four-week lows around 1.2760.

The American dollar is strengthening against the results of the US Fed meeting, which ended yesterday. The officials expectedly left the interest rate in the range of 5.25%–5.50% but acknowledged significant progress in achieving the inflation target of 2.0%. The head of the regulator Jerome Powell said that the cost of borrowing could be adjusted in September if inflation pressures continue to weaken, and the overall economic situation in the country is in line with official forecasts. He noted that the latest data indicate that the American economy remains strong, without being overheated. Overall, the September measures have already been largely priced in by the market, with the promise of a soft economic landing encouraging investors, ensuring further declines in the pair.

The pound could come under additional pressure today if the Bank of England economists decide to cut the interest rate from 5.25% to 5.00%. According to a Reuters poll, the final decision could be made by a margin of just one vote either way, as the situation in the national economy remains ambiguous. Inflation has dropped to 2.0% but the rate of price growth in the service sector remains strong, and the 5.7% wage increase in June is well above the Bank of England’s target. Some officials, such as Swati Dhingra, are in favor of a shift to “dovish” rhetoric, while others, including Catherine Mann and Hugh Pill, prefer to remain cautious.

If the Bank of England changes borrowing costs, the downward movement of the GBP/USD pair could continue, otherwise, a correction is expected.

Support and resistance

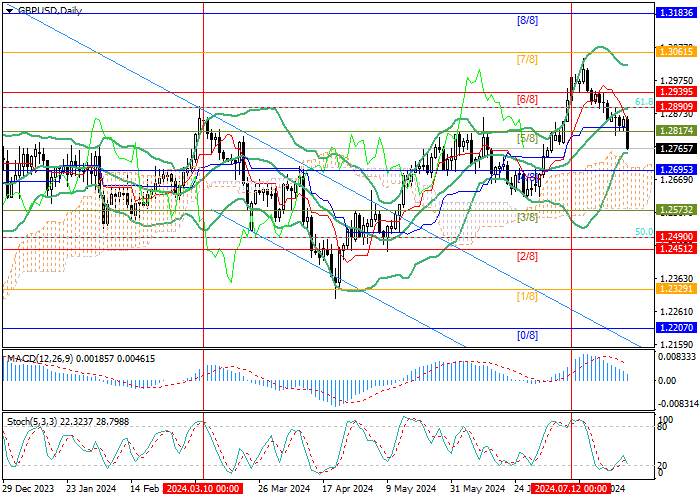

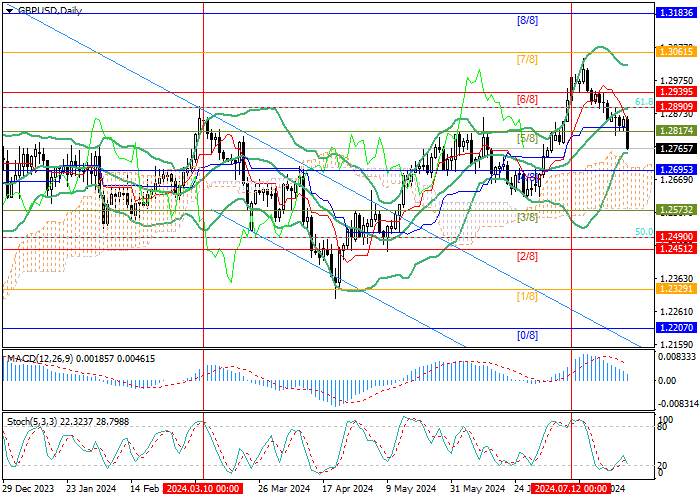

The trading instrument fell below 1.2890 (middle line of Bollinger Bands, 61.8% Fibonacci correction) and may reach 1.2695 (Murrey level [4/8]), 1.2573 (Murrey level [3/8]). If the price consolidates above the resistance zone of 1.2890–1.2939 (middle line of Bollinger Bands, 61.8% Fibonacci correction, Murrey level [6/8]), growth to 1.3061 (Murrey level [7/8]) and 1.3183 (Murrey level [8/8]) is expected.

Technical indicators do not give a single signal: Bollinger Bands are directed upwards, and Stochastic is directed downwards. The MACD histogram is preparing to move to the negative sideways.

Resistance levels: 1.2939, 1.3061, 1.3183.

Support levels: 1.2695, 1.2573.

Trading tips

Short positions may be opened from 1.2760, with the targets at 1.2695, 1.2573, and stop loss 1.2800. Implementation period: 5–7 days.

Long positions may be opened above 1.2939, with the targets at 1.3061, 1.3183, and stop loss 1.2850.

Tải thất bại ()