Current trend

The NZD/USD pair is showing quite active growth, developing a "bullish" momentum in the short and ultra-short term. The instrument is testing 0.6035 for a breakout, updating local highs from July 19. Market activity remains muted, however, as the Reserve Bank of New Zealand meets on Wednesday at 04:00 (GMT 2): analysts do not forecast changes in monetary parameters, as the desired progress in reducing inflation has not been achieved, and the movement of the national currency in the NZD/USD pair is unstable, and the upward momentum achieved at the beginning of this month has slowed down. However, updated comments from officials will be important given that the market is expecting the Fed to launch its borrowing cost reduction program in September.

Moderate support for the instrument is provided by macroeconomic publications from China, indicating a gradual recovery of the economy: the Consumer Price Index in July rose from 0.2% to 0.5% in annual terms with preliminary estimates of 0.3%, and in monthly terms it added 0.5% after –0.2%. The dynamics of producer inflation did not change compared to the previous month, amounting to the previous –0.8%, while experts expected –0.9%.

Tomorrow at 14:30 (GMT 2), the US will release July inflation data: the Consumer Price Index is forecast to slow down from 3.0% to 2.9%, and the Core CPI — from 3.3% to 3.2%. The updated statistics could have a significant impact on future decisions by the US Federal Reserve: analysts predict the cut of the interest rate in September by 25 or 50 basis points with equal likelihood.

Support and resistance

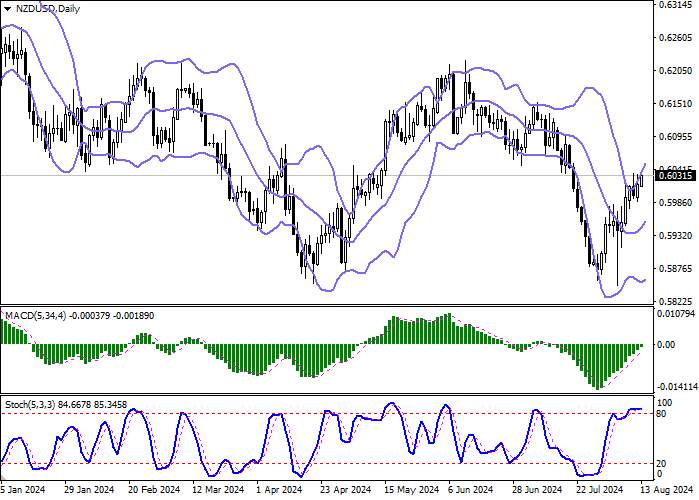

Bollinger Bands in D1 chart show active growth. The price range expands from above, freeing a path to new local highs for the "bulls". MACD grows, preserving a stable buy signal (located above the signal line). The indicator is also trying to consolidate above the zero level. Stochastic, having approached the level of "100", reversed into the horizontal plane indicating risks of overbought New Zealand dollar in the ultra-short term.

Resistance levels: 0.6047, 0.6068, 0.6085, 0.6100.

Support levels: 0.6030, 0.6000, 0.5975, 0.5950.

Trading tips

Long positions can be opened after a breakout of 0.6047 with the target of 0.6085. Stop-loss — 0.6020. Implementation time: 1-2 days.

A reversal of the instrument downward near current levels followed by a breakdown of 0.6030 may become a signal to open short positions with a target of 0.6000. Stop-loss — 0.6047.

Tải thất bại ()