| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | SELL STOP |

| Entry Point | 146.00 |

| Take Profit | 143.80 |

| Stop Loss | 147.00 |

| Key Levels | 143.80, 146.00, 147.30, 150.80 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 147.30 |

| Take Profit | 150.80 |

| Stop Loss | 146.50 |

| Key Levels | 143.80, 146.00, 147.30, 150.80 |

Current trend

The USD/JPY pair is consolidating near 147.00 as the chances of further yen appreciation are weakening despite the narrowing of the interest rate differential between the Bank of Japan and the US Fed.

The main supporter of the current monetary policy, Prime Minister Fumio Kishida, announced his decision not to run for a second term in the election of the head of the ruling Liberal Democratic Party, ending his three-year term in office during which the yen has lost more than 40.0 dollars in USD/JPY. In addition, the official has not yet completed the implementation of the new investment accounts under the NISA program, designed to increase the volume of capital investment within the country, so the domestic market may weaken, and the yen may lose the advantage gained over the past month.

The American dollar is correcting lower, trading at 102.40 in the USDX. The July producer price index published yesterday increased by only 0.1%, lower than the 0.2% expected by analysts, leading to a slowdown in the annual growth rate from 2.7% to 2.2%, although analysts expected 2.3%. The statistics increase fears about the US Fed cutting interest rates in September. Today, data on the consumer price index is due, and for now, analysts expect the indicators to remain at previous levels. According to the Chicago Mercantile Exchange (CME) FedWatch Instrument, the probability of a –50 basis point adjustment in borrowing costs is 54.5%, and if inflation slows, it may increase.

Support and resistance

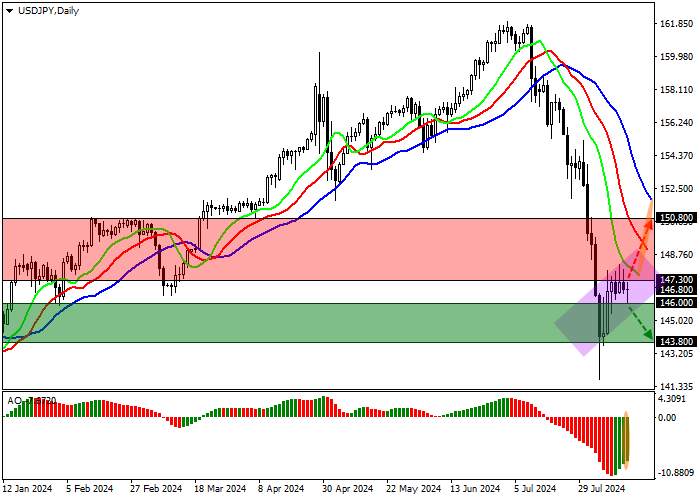

On the daily chart, the trading instrument is correcting downwards, holding slightly above the renewed year’s low of 141.80.

Technical indicators maintain a stable sell signal: fast EMA on the Alligator indicator are much lower than the signal line, and the AO histogram forms downward bars in the sell zone.

Resistance levels: 147.30, 150.80.

Support levels: 146.00, 143.80.

Trading tips

Short positions may be opened after the price consolidates below 146.00, with the target at 143.80. Stop loss is 147.00. Implementation period: 7 days or more.

Long positions may be opened after the price consolidates above 147.30, with the target at 150.80. Stop loss is 146.50.

风险提示:以上内容仅代表作者或嘉宾的观点,不代表 FOLLOWME 的任何观点及立场,且不代表 FOLLOWME 同意其说法或描述,也不构成任何投资建议。对于访问者根据 FOLLOWME 社区提供的信息所做出的一切行为,除非另有明确的书面承诺文件,否则本社区不承担任何形式的责任。

FOLLOWME 交易社区网址: www.followme.asia

加载失败()