| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY STOP |

| Entry Point | 248.05 |

| Take Profit | 266.00 |

| Stop Loss | 242.00 |

| Key Levels | 222.00, 239.00, 248.00, 266.00 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 238.95 |

| Take Profit | 222.00 |

| Stop Loss | 246.00 |

| Key Levels | 222.00, 239.00, 248.00, 266.00 |

Current trend

Shares of American Express Co., one of the leading American multinational companies providing payment transaction services, are adjusting at 243.00.

Yesterday, management announced its intention to open a new Centurion lounge with an area of more than 16.0 thousand square feet at Salt Lake City International Airport, which will be available to all cardholders of the company. Details of the project will be available as early as September 11 during the Barclays Financial Services conference, which will be attended by Christopher Le Caillec, the company's chief financial officer, who, in addition to infrastructure investments, will discuss the results of the company's recent financial report.

The emitter's financial results for the second quarter showed an increase in revenue to 16.3 billion dollars from 15.05 billion dollars last year. Earnings per share (EPS) amounted to 3.49 dollars, exceeding both the 3.23 dollars forecast by analysts and 2.89 dollars over the same period a year earlier.

Support and resistance

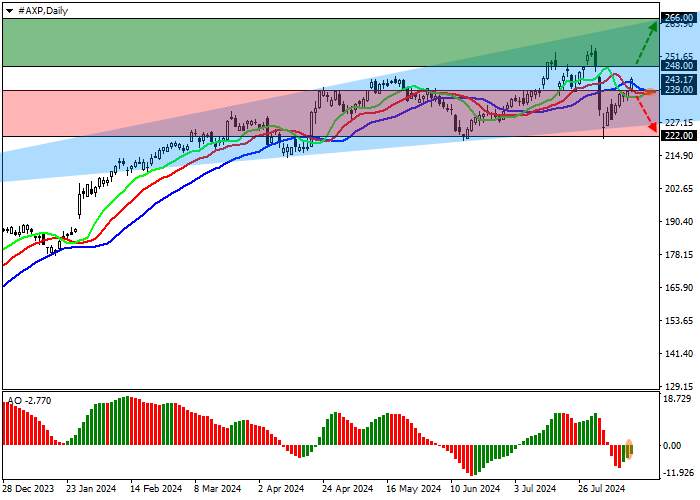

On the D1 chart, the asset is rising and trying to move further away from the support line of the "expanding formation" pattern with the boundaries of 266.00–227.00.

A global buy signal from technical indicators has not yet been received: the range of EMAs fluctuations on the Alligator indicator is directed upwards, and fast EMAs are very close to the signal line, but have not yet crossed it, while AO histogram, trading in the negative zone, forms new descending bars.

Support levels: 239.00, 222.00.

Resistance levels: 248.00, 266.00.

Trading tips

If the asset continues to grow and the price consolidates above the resistance level of 248.00, one may open long positions with the target of 266.00 and stop-loss of 242.00. Implementation period: 7 days and more.

If the asset continues to decline and the price consolidates below the support level of 239.00, short positions with the target of 222.00 and stop-loss of 246.00 will be relevant.

风险提示:以上内容仅代表作者或嘉宾的观点,不代表 FOLLOWME 的任何观点及立场,且不代表 FOLLOWME 同意其说法或描述,也不构成任何投资建议。对于访问者根据 FOLLOWME 社区提供的信息所做出的一切行为,除非另有明确的书面承诺文件,否则本社区不承担任何形式的责任。

FOLLOWME 交易社区网址: www.followme.asia

加载失败()