Current trend

The AUD/USD pair is growing towards 0.6630 after the statements of the Governor of the Reserve Bank of Australia (RBA), Michelle Bullock.

On Friday, the official said that the regulator remained focused on the possible growth of consumer prices and does not expect to cut interest rates soon. The board members believe they have found a balance between controlling inflation and maintaining stability in the current economic situation. The interest rate is 4.35%, allowing the consumer price index to return to the target range of 1.0–3.0%. However, there is no need to ease monetary policy against a strong labor market: the change in the employment level in July was 58.2K, exceeding analysts’ forecasts by more than two times, and the June figure was corrected from 50.2K to 52.3K. The unemployment rate increased from 4.1% to 4.2%, which is not critical and allows the bank to maintain the current monetary policy.

Meanwhile, the US July core retail sales rose by 0.4% MoM, above the forecast of 0.1%, and the previous value was corrected from 0.4% to 0.5%. However, the volume of industrial production changed by –0.6% MoM relative to estimates of –0.3%, and the June figure – from 0.6% to 0.3%. To find a balance and maintain the growth rate of gross domestic product (GDP), the US Fed officials will probably have to cut the interest rate at the September meeting: it may change by –25 basis points to 5.25%.

Support and resistance

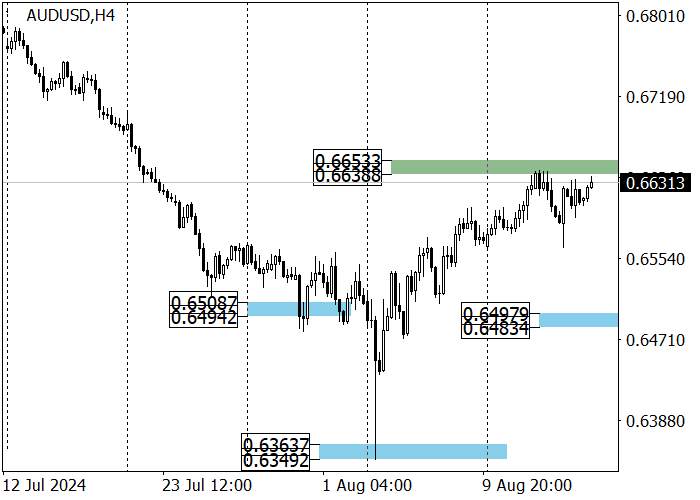

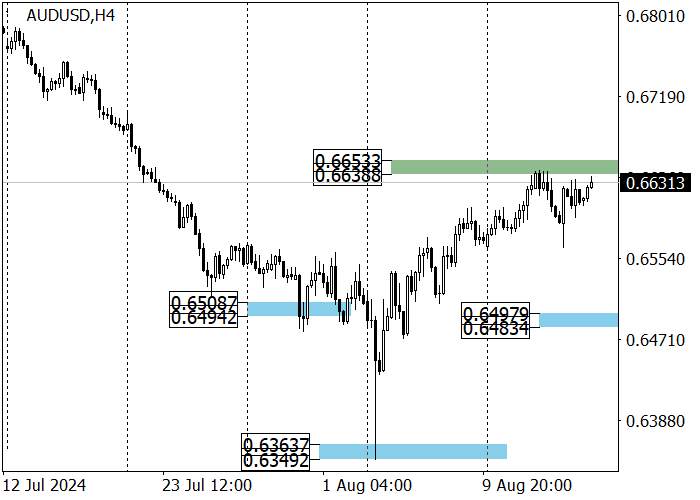

The trading instrument is correcting against the long-term downward trend: the price reached 0.6630, after overcoming which the growth will continue to the trend resistance level of 0.6703, and otherwise, a decline may of 0.6575, and then to the targets of 0.6540 and 0.6450. Since yesterday, the quotes tested the support level of 0.6540, the most likely scenario is the development of an upward trend.

The medium-term upward trend is strengthening: the asset has reached zone 2 (0.6653–0.6638), after which long positions, with the targets in zone 3 (0.6798–0.6783), are relevant. Otherwise, a correction to the area of 0.6497–0.6483 is expected, where purchases with the target at the high of the current week 0.6640 will become relevant.

Resistance levels: 0.6630, 0.6703, 0.6790.

Support levels: 0.6575, 0.6540, 0.6450.

Trading tips

Short positions may be opened from 0.6703, with the target at 0.6630 and stop loss 0.6730. Implementation period: 9–12 days.

Long positions may be opened above 0.6730, with the target at 0.6790 and stop loss 0.6703.

Tải thất bại ()