Current trend

The AUD/USD pair has been actively increasing since the beginning of August, currently holding around 0.6730, largely due to the difference in monetary approaches of the US Fed and the Reserve Bank of Australia (RBA).

In particular, if investors expect the US regulator to begin reducing interest rates soon, then Australian officials may take a break in the tightening cycle, keeping the values at current levels or even raising them again. Recall that after the publication of July inflation data in the US, which confirmed a decrease in price pressure in the economy (the index fell from 3.0% to 2.9% YoY, and the core indicator – from 3.3% to 3.2%), the likelihood of September easing of monetary stimuli increased sharply, as hinted by several officials at once. Now, traders focus on the rhetoric of the US Fed Chairman Jerome Powell at the Economic Symposium in Jackson Hole, where he may give a signal about the volume and timing of the upcoming adjustments.

Unlike their American colleagues, Australian officials are unlikely to change the cost of borrowing soon, confirmed by the minutes of the last RBA monetary policy meeting published today. They note that a cut in the interest rate in the short term is unlikely, and the value should remain high for a long period to ensure the fight against inflation. Officials also discussed the possibility of further tightening of parameters due to maintaining the core consumer price index at 3.9% and the general deterioration of financial conditions but in the end no such decision was made. At the moment, the likelihood of a correction in Australian monetary policy seems unlikely, and most experts expect it will happen no earlier than spring 2025.

Support and resistance

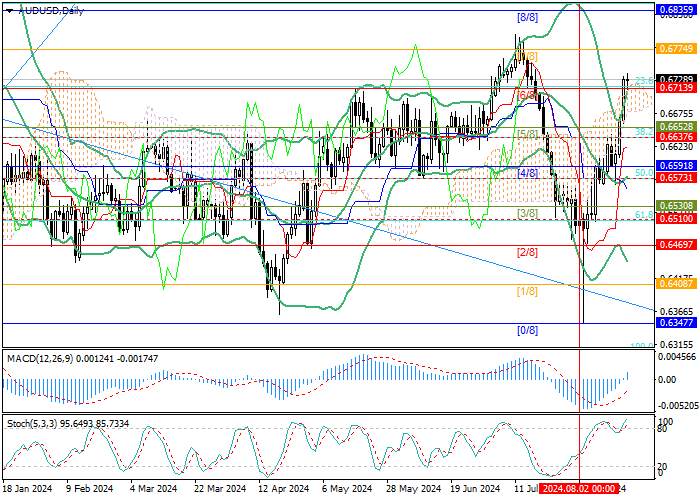

Now the price has consolidated above 0.6713 (Murrey level [6/8], Fibonacci correction 23.6%), allowing the instrument to continue growing to the targets of 0.6774 (Murrey level [7/8]), 0.6835 (Murrey level [8/8]). The breakout of the key “bearish” level of 0.6573 (Fibonacci correction 50.0%), supported by the middle line of Bollinger bands, allows the price to grow to 0.6510 (Fibonacci correction 61.8%) and 0.6469 (Murrey level [2/8]).

Technical indicators confirm the upward dynamics: Bollinger Bands are reversing upwards, MACD histogram has entered the positive zone, and Stochastic has entered the overbought zone but is directed upward.

Resistance levels: 0.6774, 0.6835.

Support levels: 0.6573, 0.6510, 0.6469.

Trading tips

Long positions may be opened from 0.6740, with the target at 0.6835 and stop loss 0.6700. Implementation period: 5–7 days.

Short positions may be opened below 0.6573, with the targets of 0.6510, 0.6469 and stop loss 0.6625.

Tải thất bại ()