#10FCOINGiveaway# Read and LIKE to grab 10 FCOIN!

#10FCOINGiveaway# Read and LIKE to grab 10 FCOIN!

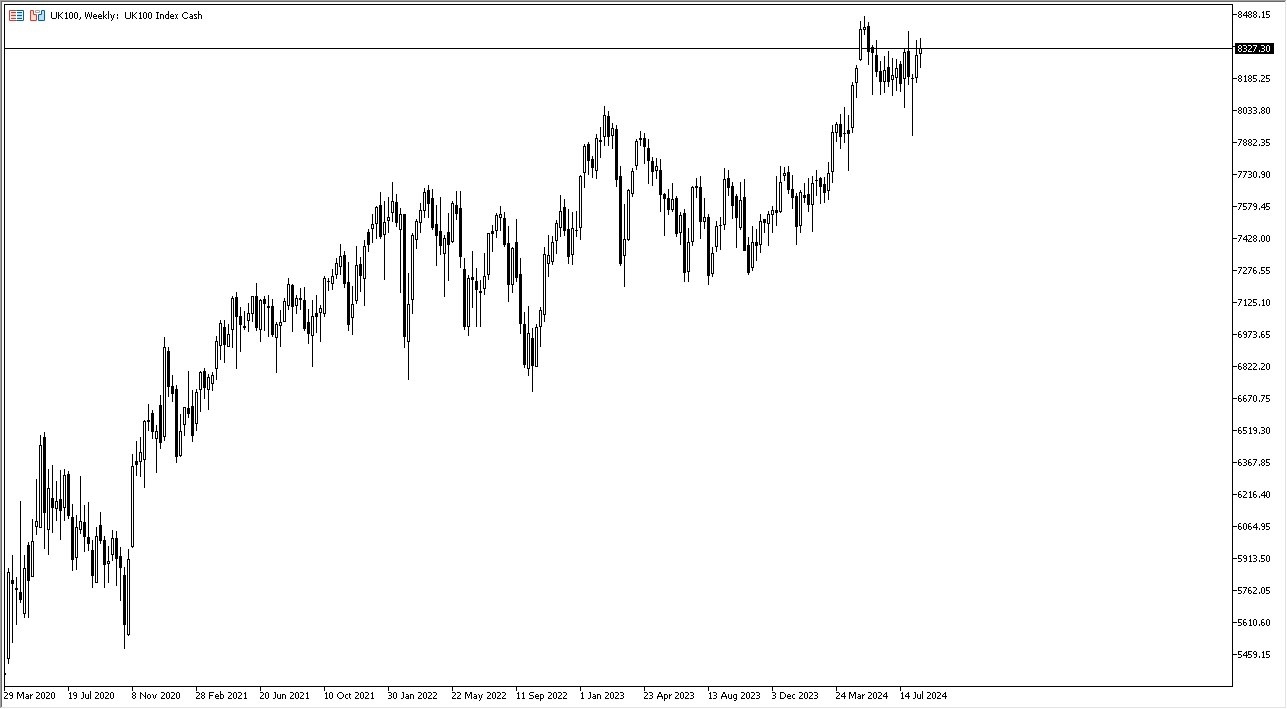

FTSE 100

The FTSE 100 initially pulled back during the week, but it appears to have plenty of support underneath. The fact that the market turned around to bounce, combined with the willingness of central banks around the world to step in and provide liquidity, suggests that in the short term, there will likely be continued rallies in many stocks, including those in London. As long as the market stays above the 8100 level, it is expected to move higher.

USD/CHF

The US dollar dropped significantly during the week, testing the 0.85 level. This area had previously been a point of support, and it’s notable that the market is revisiting it. With Jerome Powell stating on Friday that the Federal Reserve is likely to cut rates, there has been downward pressure on the US dollar. However, given the positive swap, a bounce is expected sooner rather than later. If the market breaks above the top of the weekly candlestick, it may head toward the 0.91 level.

NZD/USD

The New Zealand dollar surged during the week, breaking above the 0.62 level. If the NZD/USD market continues higher, it could potentially reach the 0.6350 level. The size of the candlestick suggests strong upward pressure, and the US dollar may weaken further due to the anticipated Federal Reserve rate cuts in the coming months.

EUR/USD

The Euro rallied significantly against the US dollar during the week, following Jerome Powell’s acknowledgment that the Federal Reserve will cut rates. The 1.1250 level above presents significant resistance, as it was previously a point of support. If the EUR/USD market shows signs of weakness, it may pull back toward the 1.11 level. Although the Euro’s direction is upward, it is not favored by some analysts.

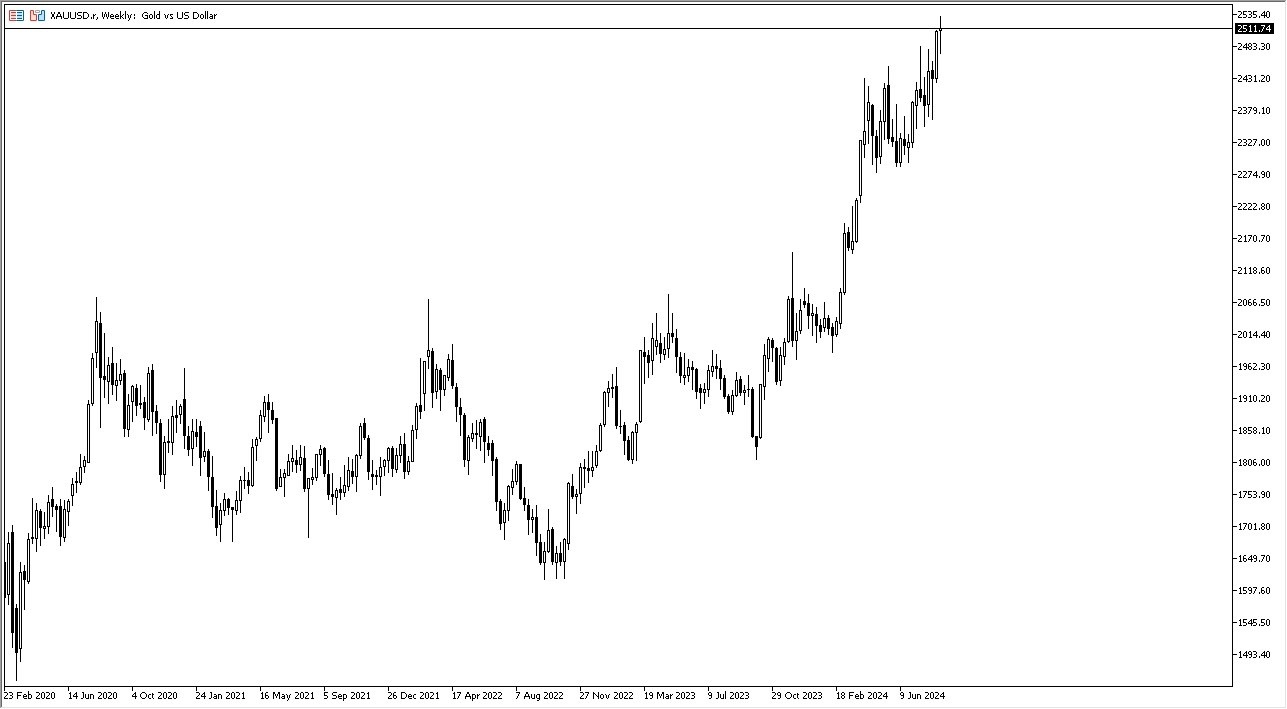

Gold

Gold markets experienced volatility during the week, with Friday bringing significant noise. Currently, gold is hovering around the $2500 level, a large, round, psychologically significant figure. The Federal Reserve’s impending rate cuts are expected to influence gold’s future movements, and the outlook for gold appears positive at this time.

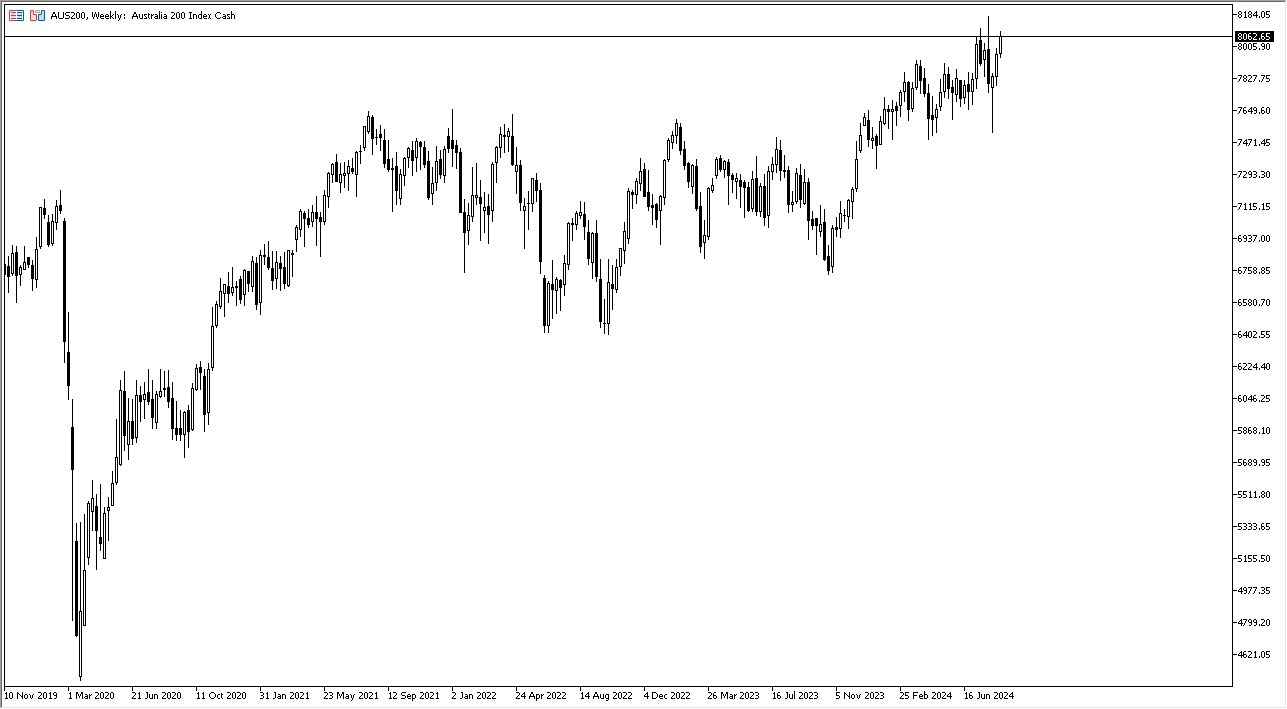

ASX 200

The Australian Stock Exchange 200 rallied during the week, approaching the AU$8100 level. Although a short-term pullback is anticipated, it is seen as a potential buying opportunity. The market appears very bullish, and even with a pullback, there are likely to be many buyers willing to invest in these equities.

USD/JPY

The US dollar plunged against the Japanese yen during the week as Jerome Powell admitted that the Federal Reserve would be cutting rates and expressed concerns about employment. The USD/JPY market is in a state of uncertainty, and despite the negative candlestick, the market did not break down. Close monitoring is advised, as a breakdown below the hammer from the candlestick two weeks ago could indicate a significant decline.

WTI Crude Oil

The West Texas Intermediate Crude Oil market pulled back slightly, showing signs of weakness, but bounced off the crucial $71.50 level. This area has been a significant point of support, and the formation of a hammer suggests that the market may move higher. The WTI Crude Oil market could potentially target the $80 level above, a large, round, psychologically significant figure, and a resistance barrier.

P.S: Comment with your forecast of this week below could get 20 FCOIN!

Tuyên bố miễn trừ trách nhiệm: Quan điểm được trình bày hoàn toàn là của tác giả và không đại diện cho quan điểm chính thức của Followme. Followme không chịu trách nhiệm về tính chính xác, đầy đủ hoặc độ tin cậy của thông tin được cung cấp và không chịu trách nhiệm cho bất kỳ hành động nào được thực hiện dựa trên nội dung, trừ khi được nêu rõ bằng văn bản.

Website Cộng đồng Giao Dịch FOLLOWME: www.followme.asia

Tải thất bại ()