Current trend

Amid the negative dynamics of the American dollar, the USD/JPY pair is correcting in a downward trend, trading at 144.00.

On Friday, Bank of Japan Governor Kazuo Ueda, speaking in parliament, commented on the regulator’s “hawkish” course, confirming his determination to raise interest rates if inflation reaches the target of 2.0%. The official emphasized that the dynamics in the markets could affect the timing of the next adjustments to the cost of borrowing. However, many experts previously accused the agency of too sharp a tightening of monetary policy, which put pressure on the national stock market. Meanwhile, macroeconomic indicators confirm the need for these measures: the July consumer price index was 2.8% against the forecast of 2.7%, and the core indicator increased from 2.6% to 2.7%. However, the June leading indicators index increased from 108.6 points to 109.0 points, while the coincident indicators index decreased from 113.7 points to 113.2 points.

The American dollar is moving in a downward trend, holding at the key level of 100.00 in USDX after the speech of the US Fed Chairman Jerome Powell at the Economic Symposium in Jackson Hole. For the first time in a long, the official noted the regulator’s readiness to reduce interest rates at the September meeting and added that department representatives are confident that inflation will slow to 2.0%. According to him, the US Fed’s attention will now be directed to achieving goals for the labor and real estate markets. Experts believe that the larger the step of adjusting the cost of borrowing, the more serious a problem officials consider the recent increase in unemployment.

Support and resistance

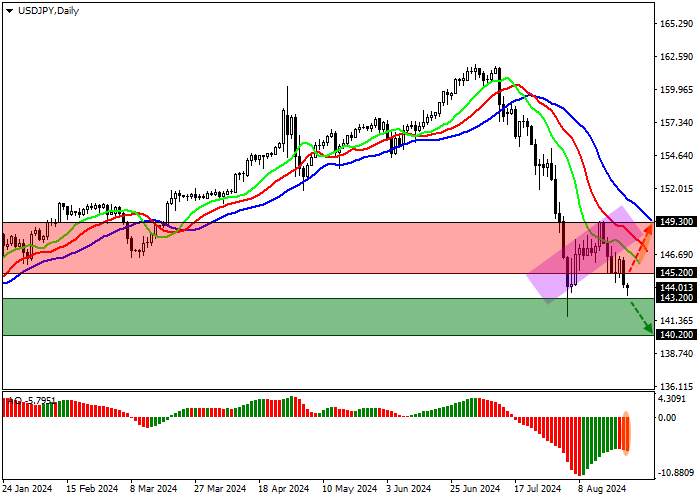

On the daily chart, the price is correcting downwards within the possible local Flag pattern with a low at 144.00.

Technical indicators maintain a stable sell signal: fast EMAs on the Alligator indicator are much lower than the signal line, and the AO histogram forms downward bars in the sell zone.

Resistance levels: 145.20, 149.30.

Support levels: 143.20, 140.20.

Trading tips

Short positions may be opened after the price declines and consolidates below 143.20, with the target at 140.20. Stop loss — 145.00. Implementation period: 7 days or more.

Long positions may be opened after the price grows and consolidates above 145.20, with the target at 149.30. Stop loss — 143.00.

Tải thất bại ()