Current trend

Shares of JPMorgan Chase & Co., one of the largest transnational financial conglomerates in the United States, are trading within a correction trend at 205.00.

Yesterday, the quotes fell by more than 11.0% after the bank’s Chief Operating Officer Daniel Pinto stated that he expected net interest income (NII) to grow inflated in the third quarter. According to him, the US Fed’s rate cut at its meeting on September 18 will weaken NII for all financial institutions that were making excess profits amid peak borrowing costs.

Leading experts agree with Pinto but do not believe this will put significant pressure on the issuer’s shares: Barclays Plc. analysts maintained their rating at overweight and the target price at 217.0 dollars per share. Analysts expect Q3 investment banking fees to rise 15.0%, driven by strong demand for debt market assets.

Q3 revenue may decline to 41.72B dollars from 50.2B dollars in the previous quarter. Profit, according to preliminary estimates, will be 4.02 dollars, which is in line with 4.4 dollars previously.

Support and resistance

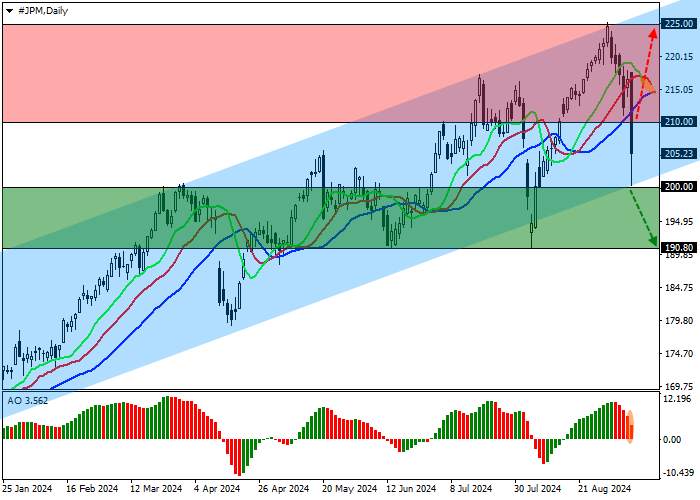

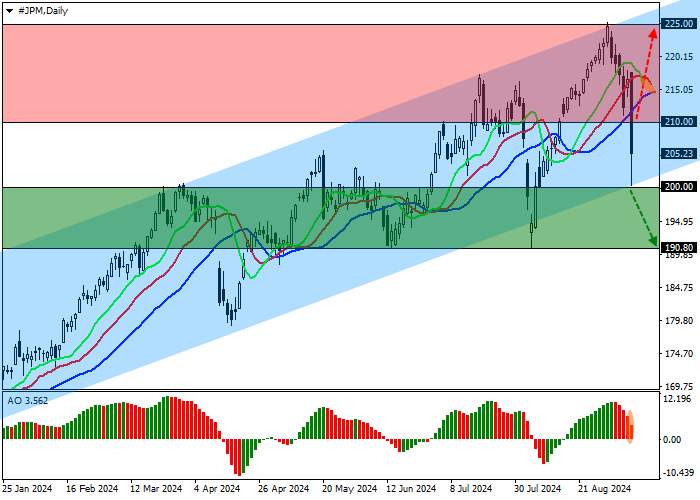

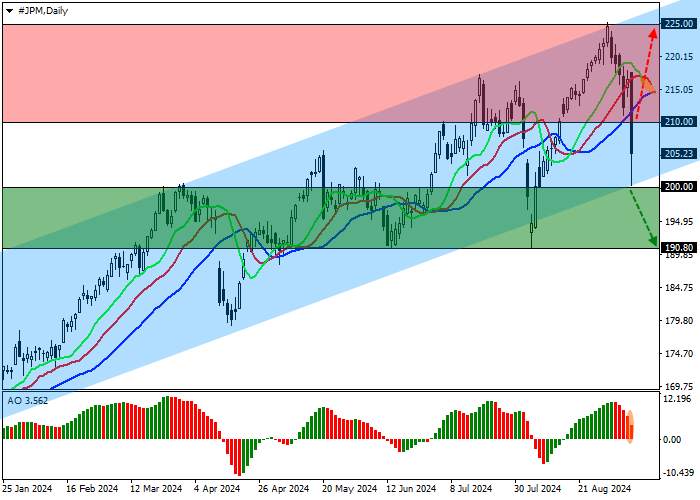

On the daily chart, the trading instrument is moving within the ascending channel 227.00–200.00, approaching the support line.

Technical indicators are ready to give a sell signal: the EMA oscillation range on the Alligator indicator reverses downwards, and the fast EMAs are approaching the signal line. The AO histogram is preparing to reverse down in the buy zone.

Resistance levels: 210.00, 225.00.

Support levels: 200.00, 190.80.

Trading tips

Short positions may be opened after the price declines and consolidates below 200.00, with the target at 190.80. Stop loss is 205.00. Implementation period: 7 days or more.

Long positions may be opened after the price grows and consolidates above 210.00, with the target at 225.00 and stop loss 205.00.

Tải thất bại ()