Current trend

The XAG/USD pair is correcting at 30.73: the asset’s dynamics are significantly lagging behind its main competitor, gold, which almost daily renews its historical highs.

Yesterday, US Fed officials began a cycle of easing monetary policy, lowering the interest rate to 4.75–5.00%, which will support alternative instruments to the dollar in the long term. Due to the reduction in the debt burden, the industry and demand for metals used in it are expected to recover, and silver is an indispensable element in the production of electric cars. In addition, the head of the regulator, Jerome Powell, noted that at least one more adjustment of the cost of borrowing is planned before the end of the year. However, it may happen closer to the end of the year since economists now need time to assess the measures taken for inflation. According to the renewed forecast, it will be 2.3%, and the gross domestic product (GDP) will grow by 2.0%.

The demand for silver contracts in yesterday’s trading increased from 66.0K to 116.0K, and the option position – from 16.322K to 25.844K. An increase in volumes may signal that investors have decided on further dynamics and are ready to enter the market.

As a result, silver is now more in demand than gold due to a more accessible investment, which can support the XAG/USD pair.

Support and resistance

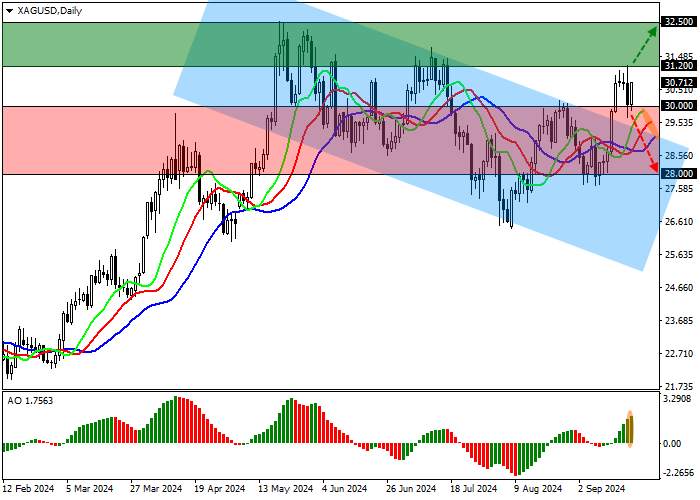

On the daily chart, the trading instrument is moving above the downward channel with dynamic boundaries of 30.00–25.60, preparing to retreat from the resistance line of 29.50.

Technical indicators are holding the buy signal: the EMA oscillation range on the Alligator indicator is directed upwards, and the AO histogram is forming new bars, rising in the buy zone.

Resistance levels: 31.20, 32.50.

Support levels: 30.00, 28.00.

Trading tips

Long positions may be opened after the price rises and consolidates above 31.20, with the target at 32.50. Stop loss — 30.50. Implementation period: 7 days or more.

Short positions may be opened after the price falls and consolidates below 30.00, with the target at 28.00. Stop loss — 31.00.

Tải thất bại ()