Current trend

During the Asian session, the GBP/USD pair is developing an upward trend in the area of 1.3295, supported by the results of the Bank of England meeting.

The day before, eight members of the Monetary Policy Committee voted to keep the interest rate at 5.00% after it was cut from a 16-year high in August. The head of the regulator, Andrew Bailey, said inflationary pressures were easing and the national economy was growing in line with government expectations, sending a signal to the market that a reduction in borrowing costs was likely to happen as early as November. The official stressed that a gradual approach to easing monetary parameters will be used so as not to put additional pressure on the economy. The August figures were mixed, with the Consumer Price Index rising to 0.3% from 0.2% and remaining flat at 2.2% year-on-year, while the Core CPI accelerated to 3.6% from 3.3%, beating forecasts of 3.5%. The Retail Price Index slowed down year-on-year from 3.6% to 3.4%, but accelerated month-on-month from 0.1% to 0.6%. At the same time, analysts are concerned about low economic activity in the country: in July, Gross Domestic Product (GDP) showed zero dynamics for the second month in a row, with preliminary estimates of 0.2%. In turn, Industrial Production volumes in annual terms fell by 1.2% after –1.4% in the previous month, while experts expected –0.2%, and in monthly terms the indicator lost 0.8% after growing by a similar amount in June.

The US currency's position remains under pressure after the publication of the results of the two-day meeting of the US Federal Reserve last Wednesday. As expected, the regulator reduced the interest rate by 50 basis points to 5.00%, and also indicated its readiness to further reduce the indicator by approximately another 60 basis points by the end of the current year. At the same time, officials slightly adjusted their forecasts for US GDP dynamics in 2024 from 2.1% to 2.0%, and inflation expectations for the end of this year were revised from 2.6% to 2.3%, which is also a signal for further easing of monetary policy until the end of 2024.

Support and resistance

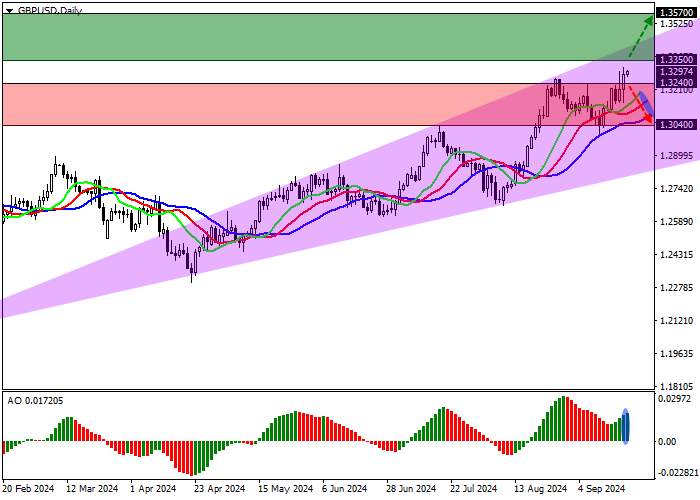

On the daily chart, the instrument marked another attempt to reach the resistance line of the Expanding Formation pattern with boundaries of 1.3460–1.2800.

Technical indicators hold a buy signal, which has begun to strengthen: fast EMAs on the Alligator indicator are kept at a considerable distance from the signal line, and the AO histogram forms new upward bars, being in the buying zone.

Support levels: 1.3240, 1.3040.

Resistance levels: 1.3350, 1.3570.

Trading tips

Long positions can be opened when the price consolidates above the resistance level of 1.3350 with the target of 1.3570. Stop-loss – 1.3270. Implementation time: 7 days and more.

Short positions can be opened after a reversal, as well as price consolidation below the support level of 1.3240 with the target of 1.3040. Stop-loss — 1.3320.

Tải thất bại ()