Current trend

The GBP/USD pair is trading with near-zero dynamics, consolidating near 1.3315. The pound is still holding near the record highs of March 2022, updated at the end of last week with the support of the results of the US Federal Reserve meeting: the regulator for the first time in the last 4.5 years cut the interest rate by 50 basis points at once, confirming the opinion of participants in the cakes about the transition to a "dovish" rate against the backdrop of a slowdown in inflation. Financial authorities have signaled the likelihood of adjusting the cost of borrowing to 4.40%, and in 2025, the US Federal Reserve could drop the rate by another percentage point if macroeconomic data is positive. On Friday, the market was pricing in around 49.0% and 51.0%, respectively, for a change in the indicator by –25 and –50 basis points at the next meeting on November 7.

In turn, the Bank of England kept borrowing costs unchanged: only one of nine board members spoke in favor of reducing them. The Chair of the Fed, Andrew Bailey, said that a cautious approach to adjusting monetary parameters was needed so as not to put pressure on the national economy. The decision came a day after statistics showed the Consumer Price Index fell from 3.5% to 3.3% year-on-year, compared with preliminary estimates of 3.4%, while the broader measure rose from 2.0% to 2.2%, compared with analysts' expectations of 2.3%, and fell 0.2% month-on-month after rising 0.1%.

Meanwhile, Friday's data supported the pound's position: Retail Sales in annual terms added 2.5% in August after increasing by 1.5% earlier, while analysts expected 1.4%, and in monthly terms the indicator accelerated from 0.5% to 1.0% with a forecast of 0.4%, while sales excluding fuel adjusted from 0.7% to 1.1% in monthly terms and from 1.4% to 2.3% in annual terms.

Support and resistance

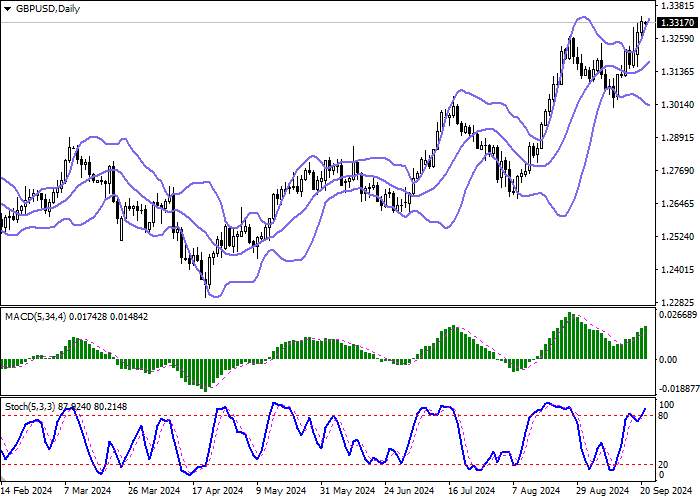

Bollinger Bands on the daily chart show moderate growth. The price range is expanding but it fails to conform to the surge of "bullish" sentiments at the moment. MACD grows, preserving a stable buy signal (located above the signal line). Stochastic retains an uptrend, but is located in close proximity to its highs, which points to the risk of overbought pound in the ultra-short term.

Resistance levels: 1.3340, 1.3375, 1.3435, 1.3500.

Support levels: 1.3300, 1.3250, 1.3200, 1.3150.

Trading tips

Long positions can be opened after a breakout of 1.3340 with the target of 1.3450. Stop-loss — 1.3300. Implementation time: 1-2 days.

Short positions should be opened at the current price with a target of 1.3200 and a stop loss of 1.3290.

Tải thất bại ()