Current trend

The USD/CHF pair is correcting against the US currency, stabilizing at 0.8497. The franc remains quite strong against the unstable dynamics of other developed countries’ currencies, so financial authorities do not need to take tough restrictive measures regarding monetary policy.

Tomorrow, the Swiss National Bank will hold a meeting, where officials may adjust the interest rate by –25 basis points from 1.25% to 1.00%. It will be the third reduction since spring when the regulator announced the final victory over inflation. Thus, the consumer price index is 1.1%, almost in the middle of the target range of 1.0–2.0%, leveling out the negative consequences of the gradual monetary policy easing. According to the SNB plans, the cost of borrowing should be 0.75% by March 2025, after which no changes will be made until 2026, maintaining the stability of the franc.

The American dollar, which tested the year’s lows around 99.50 in USDX yesterday, is rising to 100.50 today. Contrary to forecasts of 699.0K, new home sales amounted to 716.0K, supporting the national currency. In addition, the number of issued building permits increased from 1.406M to 1.470M, confirming the recovery of the lagging sector.

In these conditions, a local increase in the USD/CHF pair or sideways dynamics is the most likely scenario.

Support and resistance

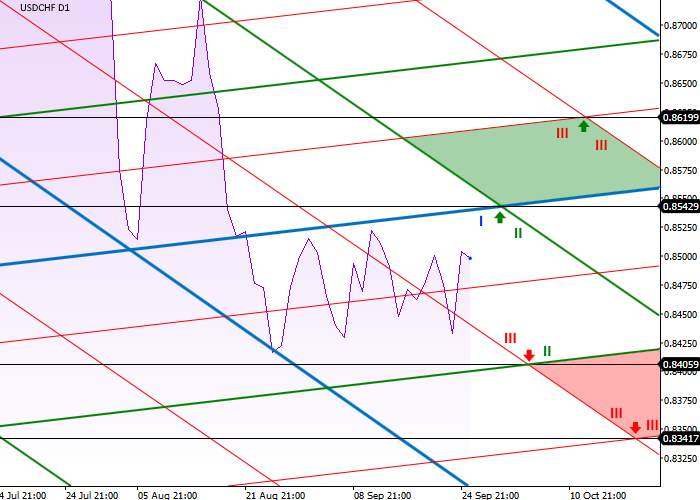

On the daily chart, the trading instrument moves between the first-order levels (I), and after testing both boundaries, it is in the sideways range of 0.8500–0.8420. The most probable scenario is growth to the crossroad of the left resistance of the first order (I) and the right resistance of the second order (II) at 0.8542 and to the crossroad of the right resistance of the third order (III) and the left resistance of the third order (III) at 0.8619.

In case of a reversal and decline, the dynamics will develop in a poor downward trend with a short-term target at the crossroad of the left support of the third order (III) and the right support of the second order (II) at 0.8405. A long-term target is the crossroad of the right support of the third order (III) and the left support of the third order (III) at 0.8341.

Resistance levels: 0.8542, 0.8619.

Support levels: 0.8405, 0.8341.

Trading tips

Long positions may be opened after the price consolidates above 0.8542, with the target at 0.8619. Stop loss – 0.8500. Implementation period: 7 days or more.

Short positions may be opened after the price consolidates below 0.8405, with the target at 0.8341. Stop loss is around 0.8430.

Tải thất bại ()