Current trend

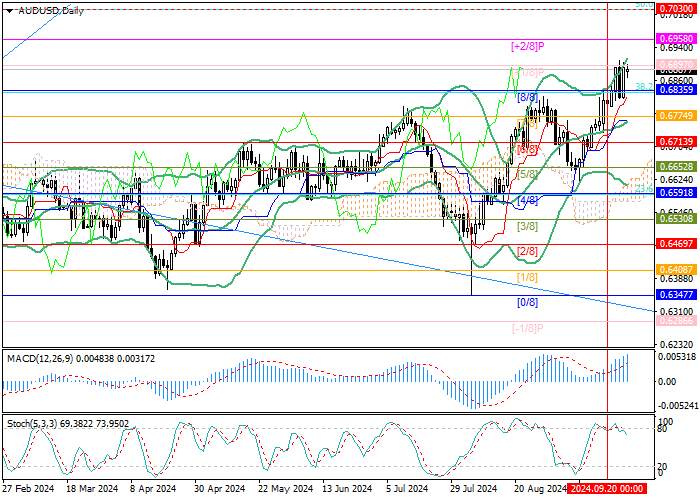

During today's trading, the AUD/USD pair tested the 0.6897 mark (Murrey level [ 1/8]): the uptrend in quotes is still supported by differences in the monetary approaches of the US Federal Reserve and the Reserve Bank of Australia (RBA).

Last week, the US regulator lowered the key rate from 5.50% to 5.00%, and then officials actively hinted at the continuation of the "dovish" course to prevent excessive pressure on the labor market and accelerate the rate of unemployment. Currently, most experts expect a twofold reduction in the cost of borrowing by the end of the year, in November and December, with a total volume of 50-75 basis points. Unlike their American counterparts, representatives of the RBA this month kept the key rate at 4.35%, and their accompanying statements were more neutral. Thus, the head of the regulator, Michele Bullock, noted that the beginning of monetary policy easing should not be expected in the near future, which contributed to the correction of the AUD/USD pair to the area of 0.6817, but then the quotes managed to restore the lost positions.

Today at 14:30 (GMT 2), investors expect the publication of August data on the price index of private consumption expenditures in the United States: MoM, the indicator may remain at 0.2%, and YoY, it may grow from 2.6% to 2.7%. The implementation of forecasts may slow down the further growth of quotes, but it is unlikely to lead to a change in the current uptrend.

Support and resistance

The price is testing the level of 0.6897 (Murrey level [ 1/8]), consolidating above which will allow the quotes to continue growing to the levels of 0.6958 (Murrey level [ 2/8]) and 0.7030 (50.0% Fibonacci retracement). The key for the "bears" is the 0.6775 mark (Murrey level [7/8]), supported by the central line of the Bollinger bands, the breakdown of which will ensure the development of downward dynamics towards the targets of 0.6652 (Murrey level [5/8]) and 0.6591 (Murrey level [4/8], 23.6% Fibonacci retracement).

Technical indicators confirm the continuation of the uptrend: Bollinger Bands are reversing up, MACD is increasing in the positive zone, and Stochastic's exit from the overbought zone does not exclude a corrective decline, but its potential is limited.

Resistance levels: 0.6897, 0.6958, 0.7030.

Support levels: 0.6775, 0.6652, 0.6591.

Trading tips

Long positions can be opened above 0.6897 or after a price reversal around 0.6775 with targets of 0.6958, 0.7030 and stop-losses around 0.6855 and 0.6725, respectively. Implementation period: 5–7 days.

Tải thất bại ()