| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY STOP |

| Entry Point | 144.80 |

| Take Profit | 149.30 |

| Stop Loss | 143.80 |

| Key Levels | 138.00, 142.20, 144.80, 149.30 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 142.20 |

| Take Profit | 138.00 |

| Stop Loss | 143.40 |

| Key Levels | 138.00, 142.20, 144.80, 149.30 |

Current trend

The USD/JPY pair is correcting in a sideways trend at 143.75. After a decline, the yen is stabilizing against positive macroeconomic data.

Thus, in August, the unemployment rate fell from 2.7% to 2.5% against the forecast of 2.6%, while the ratio of open vacancies to applicants fell from 1.24 points to 1.23 points, reflecting a high employment rate of vacant jobs. The Tankan index of capital expenditures of large enterprises fell from 11.1% to 10.6%, the business activity indicator remained at 14.0 points, and the sentiment indicator of large manufacturers – was at 13.0 points. The Bank of Japan, in turn, is considering further tightening monetary policy. However, analysts are assessing the scenario with an increase in the interest rate at the next meeting as unlikely due to insufficient inflation. Thus, in September, the consumer price index in the Tokyo region changed from 2.6% to 2.2%, and the value excluding food and energy for the same period remained at 1.6%.

The American dollar is moving in a correction trend, trading at 100.8 points in the USDX. Yesterday, it grew after the publication of a positive August JOLTS report, where the number of open vacancies increased from 7.711M to 8.040M, above the expected 7.640M. Despite the recovery in the employment sector, the September manufacturing PMI adjusted from 47.9 points to 47.3 points, and the Institute for Supply Management (ISM) manufacturing PMI remained at 47.2 points relative to the calculations of 47.6 points.

Support and resistance

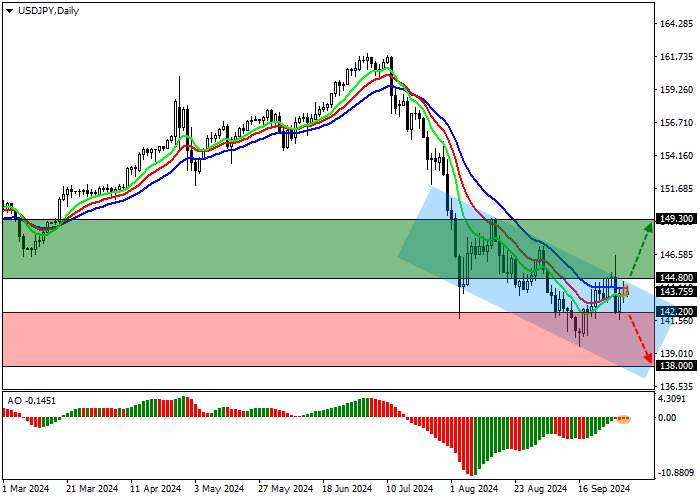

On the daily chart, the trading instrument is correcting upwards within the downward channel of 145.00–138.00.

Technical indicators are slowing down the sell signal: fast EMAs on the Alligator indicator are approaching the signal line, and the AO histogram is forming ascending bars in the sell zone.

Resistance levels: 144.80, 149.30.

Support levels: 142.20, 138.00.

Trading tips

Long positions may be opened after the price rises and consolidates above 144.80, with the target at 149.30. Stop loss — 143.80. Implementation period: 7 days or more.

Short positions may be opened after the price falls and consolidates below 142.20, with the target at 138.00. Stop loss — 143.40.

风险提示:以上内容仅代表作者或嘉宾的观点,不代表 FOLLOWME 的任何观点及立场,且不代表 FOLLOWME 同意其说法或描述,也不构成任何投资建议。对于访问者根据 FOLLOWME 社区提供的信息所做出的一切行为,除非另有明确的书面承诺文件,否则本社区不承担任何形式的责任。

FOLLOWME 交易社区网址: www.followme.asia

加载失败()