Current trend

The EUR/USD pair is trading at 1.0968: although the macroeconomic data from the EU last week was stable, the European currency is in a downward trend.

European Central Bank (ECB) officials support the head of the regulator, Christine Lagarde, and agree on the need to continue cutting interest rates. Thus, member of the Governing Council Mario Centeno said that the labor market is cooling significantly, which could lead to a decrease in investment and slow economic growth below the normal rate. However, the number of vacancies has decreased by 20.0% compared to two years ago, and the number of new employees is 10.0% below the high recorded in the second quarter of 2022. At the same time, he acknowledged that inflation in the region is under control, and officials will make every effort to keep it at the target level of 2.0%. On Friday, his colleague Francois Villeroy de Galhau also spoke in favor of a possible easing of monetary policy, stating that against an expected slowdown in inflation, a reduction in the adjustment of the cost of borrowing at the meeting on October 17 is practically a done deal, and there are doubts only about its size. Confirmation of this position may be received today when the ECB Chief Economist Philip Lane and member of the Executive Board Piero Cipollone will speak. The probability of a change in the indicator by more than –25 basis points is very high, which could put pressure on the euro in the short term.

On Monday, investors will focus on the August EU retail sales. Forecasts suggest a slight increase in the indicator from 0.1% to 0.2%. In the meantime, the August factory orders in Germany fell by 5.8% after growing by 3.9% earlier against expectations of a decrease of 2.0% MoM and 3.9% after growing by 4.6% YoY.

The American dollar is rising, holding around 102.20 in USDX. The report on the labor market was very positive. The September unemployment fell to 4.1% from 4.2% earlier due to a nonfarm payroll increase by 254K workers compared to 159.0K earlier. The private nonfarm payrolls grew by 223.0K, significantly higher than the 114.0K jobs in August and the projected 125.0K. Now, according to the Chicago Mercantile Exchange (CME) FedWatch Instrument, the probability of an interest rate adjustment by –50 basis points in November is below 30.0%, while the week before last, before the speech of US Fed Chairman Jerome Powell, it exceeded 60.0%.

Support and resistance

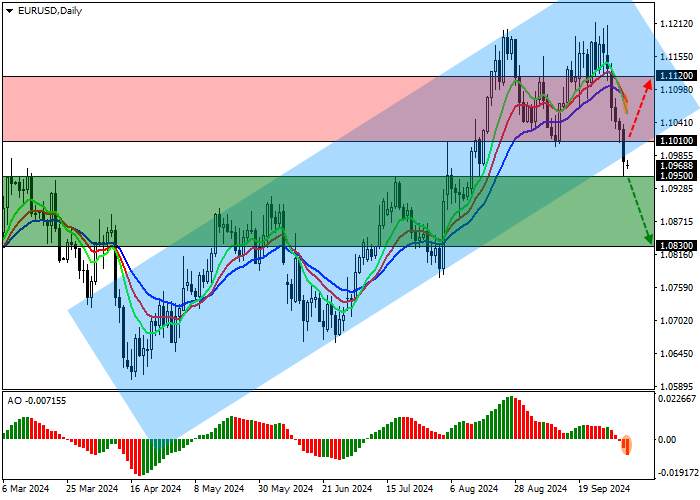

On the daily chart, the trading instrument is correcting, trying to leave the ascending channel with dynamic boundaries of 1.1330–1.1000.

Technical indicators gave a sell signal: fast EMAs on the Alligator indicator were below the signal line, expanding the range of fluctuations, and the AO histogram is forming correction bars in the sell zone.

Resistance levels: 1.1010, 1.1120.

Support levels: 1.0950, 1.0830.

Trading tips

Short positions may be opened after the price declines and consolidates below 1.0950, with the target at 1.0830. Stop loss — 1.1020. Implementation period: 7 days or more.

Long positions may be opened after the price grows and consolidates above 1.1010, with the target at 1.1120. Stop loss — 1.0950.

Tải thất bại ()