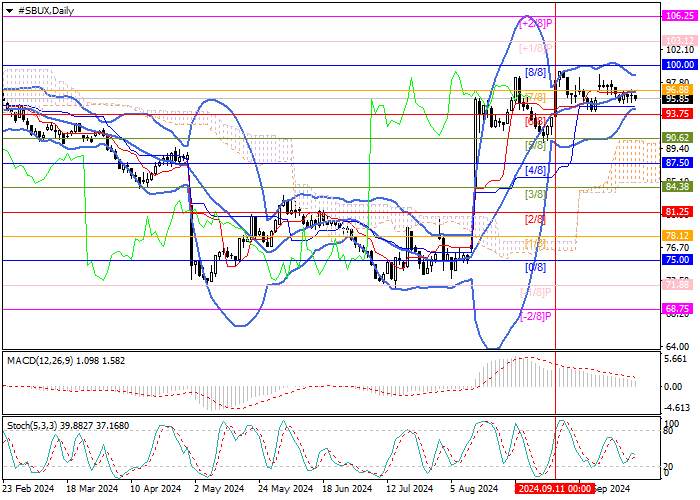

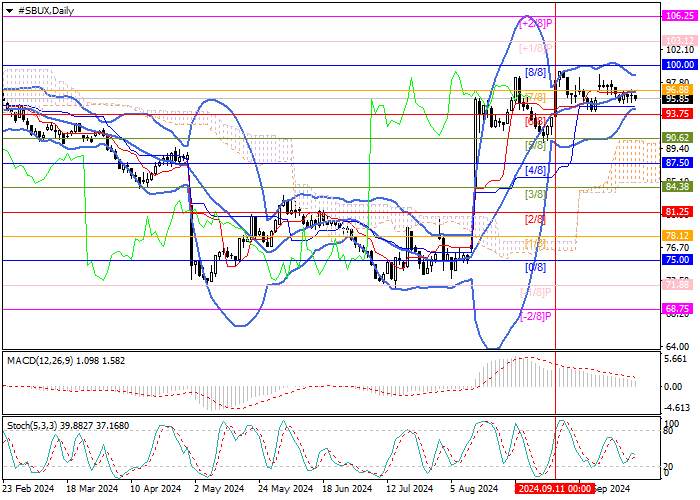

Current trend

Shares of Starbucks Corp., one of the largest companies that owns the coffee chain of the same name, have been trading in the sideways range of 100.00–93.75 (Murrey level [8/8]–[6/8]) for several weeks and cannot leave it yet. If its upper limit is broken, the quotes will continue to grow in the upper reversal zone of the Murrey trading range towards the targets of 103.12 (Murrey level [ 1/8]) and 106.25 (Murrey level [ 2/8]). Consolidation below its lower limit can cause a strengthening of downward dynamics to the levels of 87.50 (Murrey level [4/8]) and 84.38 (Murrey level [3/8]).

Technical indicators confirm the likelihood of further growth: Bollinger Bands and Stochastic are reversing up, MACD is decreasing, but remains in a positive zone. If the long-term uptrend in the instrument persists, further price growth is seen as the most likely scenario.

Support and resistance

Resistance levels: 100.00, 103.12, 106.25.

Support levels: 93.75, 87.50, 84.38.

Trading tips

Long positions can be opened above the 100.00 mark with targets of 103.12, 106.25 and a stop-loss around 97.60. Implementation period: 5–7 days.

Short positions should be opened below the level of 93.75 with targets 87.50, 84.38 and a stop-loss around 98.20.

Tải thất bại ()