Current trend

The shares of one of the leaders of the global entertainment industry, The Walt Disney Co., are trading in a corrective trend around 94.00.

Leading analysts are in no hurry to change forecasts regarding the emitter's securities against the background of Hurricane Milton, which hit the United States last week and caused significant damage to infrastructure, which caused Walt Disney World theme parks in Florida to be closed, negatively affecting the company's profits. Goldman Sachs experts maintained a "buy" rating for shares of The Walt Disney Co., and the target price was fixed at 120.0 dollars per share. Analysts believe that even taking into account the expected losses of the company after the disaster, estimated at 100.0 million dollars and about -4.0% of attendance, global indicators will remain stable. Goldman Sachs still expects earnings per share (EPS) in the fourth quarter to be 1.16 dollars, which exceeds the consensus estimate of 1.10 dollars, and in 2025, experts predict a decline to 5.14 dollars from 5.22 dollars previously, but this is still above the consensus estimate of 5.13 dollars.

The company's quarterly report will be published on November 14 and, according to forecasts, revenue will amount to 22.48 billion dollars, below 23.2 billion dollars in the previous quarter, but exceeding 21.24 billion dollars over the same period a year earlier, and EPS are likely to reach 1.11 dollars compared to 0.82 dollars last year and 1.39 dollars over the previous quarter.

Support and resistance

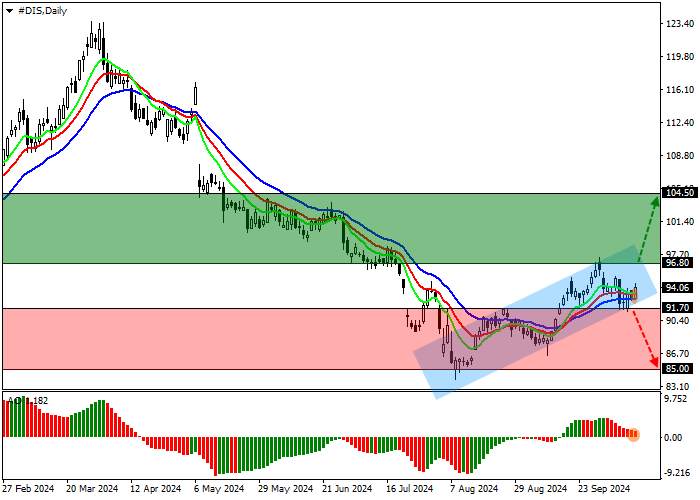

On the D1 chart, the company's stock quotes are trading just above the support line of the ascending channel with the boundaries of 100.00–91.00.

Technical indicators hold a buy signal, which slows down within a local correction: the fast EMAs of the Alligator indicator remain above the signal line, and the AO histogram is in the buy zone, forming new correction bars.

Support levels: 91.70, 85.00.

Resistance levels: 96.80, 104.50.

Trading tips

In case of continued corrective growth, as well as price consolidation above the resistance level of 96.80, buy positions with a target of 104.50 will be relevant. Stop-loss – 93.00. Implementation period: 7 days and more.

In case of continued corrective decline, as well as price consolidation below the support level of 91.70, one may open sell positions with a target of 85.00 and a stop-loss of 95.00.

Tải thất bại ()