Current trend

Against the start of the corporate reporting period, the leading index of the Frankfurt Stock Exchange DAX 40 is rising, trading at 19608.0.

Thus, at the end of last week, the Schlumberger NV concern published its statistics, reporting quarterly revenue of 8.44B euros, below analysts’ forecast of 8.45B euros, and earnings per share (EPS) amounted to 0.8197 euros, exceeding expectations of 0.8072 euros. In addition, the revenue of EssilorLuxottica SA decreased from 6.93B euros to 6.44B euros compared to estimates of 6.53B euros.

Meanwhile, in September, the German producer price index adjusted from 0.2% to –0.5% MoM and from –0.8% to –1.4% YoY, reflecting a further slowdown in production inflation.

Amid another cut in interest rates by the European Central Bank (ECB), yields on leading bonds are adjusting. Popular 10-year German bonds are trading at 2.183%, down from 2.269% last week, long-term 20-year bonds are at 2.497% compared to 2.566% in early October, and global 30-year bonds are at 2.502% compared to a high of 2.569% on October 14.

Among the growth leaders, we can note Daimler Truck Holding AG ( 6.60%), Continental AG ( 3.71%), BASF SE ( 1.71%), Porsche Automobil Holding SE ( 1.44%).

Among the companies demonstrating a downward trend, we can highlight Zalando SE (–1.81%), Commerzbank AG (–1.37%) and Airbus Group SE (–1.10%).

Support and resistance

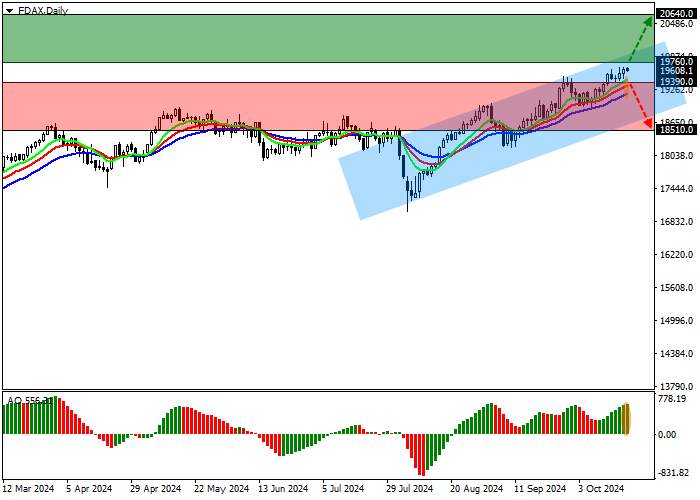

On the daily chart, the trading instrument is rising in a corrective trend, approaching the resistance line of the ascending channel with dynamic boundaries of 20000.0–18900.0.

Technical indicators are holding the buy signal: fast EMAs on the Alligator indicator are moving away from the signal line, and the AO histogram is forming corrective bars in the buy zone.

Resistance levels: 19760.0, 20640.0.

Support levels: 19390.0, 18510.0.

Trading tips

Long positions may be opened after the price rises and consolidates above 19760.0, with the target at 20640.0. Stop loss is around 19300.0. Implementation period: 7 days or more.

Short positions may be opened after the price falls and consolidates below 19390.0, with the target at 18510.0. Stop loss is 19800.0.

Tải thất bại ()