Current trend

The EUR/USD pair is moving in a downward trend at 1.0800 amid a strengthening American dollar and subdued comments from European Central Bank (ECB) officials regarding the EU economic situation.

Thus, yesterday, the regulator’s representative, Mario Centeno, said the nominal target for interest rates will be below 2.00%. Although the financial authorities are actively taking measures, the current level of 3.25% is significantly higher than the required neutral position. According to the official, as long as inflation is steadily declining and other indicators of economic activity remain stable, the ECB should reduce the cost of borrowing to support the EU economy.

The American dollar is rising, trading at 103.90 in the USDX. As the US presidential election approaches, their influence on the opinion of stock market players is increasing. Thus, most experts assume that the victory of the Republican candidate, Donald Trump, will be the most positive scenario for the national currency. However, according to the latest Reuters/Ipsos polls, the Democratic candidate, Kamala Harris, is still slightly ahead.

Today at 16:00 (GMT 2), investors will pay attention to the reports on the real estate market: existing home sales may increase from 3.86M to 3.88M, supporting the national currency.

Support and resistance

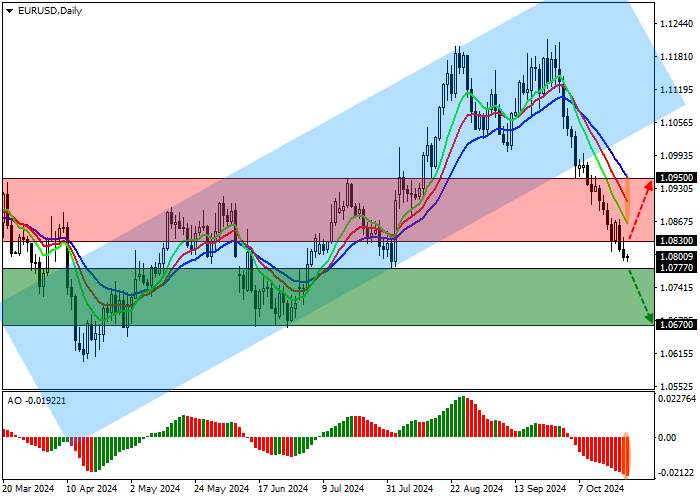

On the daily chart, the trading instrument retreats from the support line of the ascending channel with dynamic boundaries of 1.1250–1.1000.

Technical indicators hold the sell signal: fast EMAs on the Alligator indicator have consolidated below the signal line, expanding the range of fluctuations, and the AO histogram is forming correction bars, declining in the sell zone.

Resistance levels: 1.0830, 1.0950.

Support levels: 1.0777, 1.0670.

Trading tips

Short positions may be opened after the price declines and consolidates below 1.0777, with the target at 1.0670. Stop loss — 1.0820. Implementation period: 7 days or more.

Long positions may be opened after the price grows and consolidates above 1.0830, with the target at 1.0950. Stop loss — 1.0790.

Tải thất bại ()