| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY STOP |

| Entry Point | 1.3895 |

| Take Profit | 1.4060 |

| Stop Loss | 1.3850 |

| Key Levels | 1.3610, 1.3810, 1.3890, 1.4060 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 1.3805 |

| Take Profit | 1.3610 |

| Stop Loss | 1.3900 |

| Key Levels | 1.3610, 1.3810, 1.3890, 1.4060 |

Current trend

Amid the weakening of the American dollar, the USD/CAD pair is correcting at 1.3853.

The Canadian currency remains under pressure despite the easing of monetary policy by the Bank of Canada: the overnight target rate is now 3.25%, the bank rate is 4.00%, and the deposit rate is 3.75%. According to officials, the unemployment rate will be 6.5% in the second half of the year, and the economic growth rate will slow from 2.00% to 1.75%. The adjustment in the cost of borrowing should stimulate its recovery, and now, the gross domestic product (GDP) in 2024 may reach 1.2%, gradually strengthening to 2.1% in 2025 and 2.3% in 2026. Inflation returned to the target range below 2.0%, amounting to 1.6%, allowing the regulator to adjust the interest rate by –50 basis points. As long as the consumer price index remains within these limits, the bank will focus on economic growth.

The American dollar is holding at 103.80 in the USDX, having fallen amid poor September data on the real estate sector, the most lagging sector of the national economy. Building permits fell from 4.6% to –3.1% or from 1.470M to 1.425M but new home sales increased from 709.0K to 738.0K, a high for the year, which did not have a significant impact on the situation.

Support and resistance

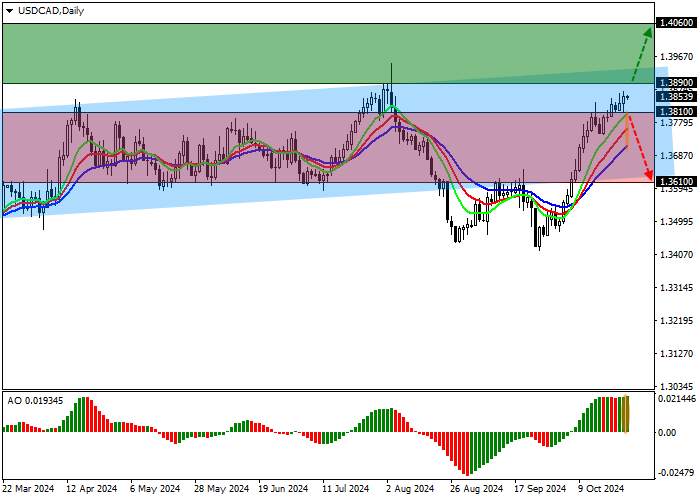

On the daily chart, the trading instrument is correcting, returning to the ascending channel with dynamic boundaries of 1.4000–1.3620.

Technical indicators strengthen the buy signal: the EMA oscillation range on the Alligator indicator is expanding, fast EMAs are moving away from each other, and the AO histogram is forming correction bars, retreating from the upward transition level.

Resistance levels: 1.3890, 1.4060.

Support levels: 1.3810, 1.3610.

Trading tips

Long positions may be opened after the price rises and consolidates above 1.3890, with the target at 1.4060. Stop loss is 1.3850. Implementation period: 7 days or more.

Short positions may be opened after the price falls and consolidates below 1.3810, with the target at 1.3610. Stop loss is 1.3900.

风险提示:以上内容仅代表作者或嘉宾的观点,不代表 FOLLOWME 的任何观点及立场,且不代表 FOLLOWME 同意其说法或描述,也不构成任何投资建议。对于访问者根据 FOLLOWME 社区提供的信息所做出的一切行为,除非另有明确的书面承诺文件,否则本社区不承担任何形式的责任。

FOLLOWME 交易社区网址: www.followme.asia

加载失败()