Current trend

WTI Crude Oil prices continue their downward trend, once again approaching the key level of 70.00.

The asset continues to respond to the complex geopolitical situation in the Middle East: according to reports from Iran, the state's Supreme Leader Ayatollah Ali Khamenei ordered the army to go on full alert and develop several response plans if Israel attacks the country, especially oil or nuclear facilities. This statement led to increased tension in the market.

This week, reports on "black gold" reserves were published by the American Petroleum Institute (API) and the Energy Information Administration (EIA) of the US Department of Energy. According to the data presented, the API reported an increase in crude oil inventories in storage by 1.643 million barrels compared to –1.580 million barrels a week earlier, and the EIA recorded an increase of 5.474 million barrels after –2.191 million barrels last week, which slowed the possible growth of asset quotes, leaving them at current levels.

The new round of escalation in the Middle East has also led to a significant reduction in trading volumes on commodity exchanges. The Chicago Mercantile Exchange (CME Group Inc.) reports a drop in daily trading volume in WTI Crude Oil contracts yesterday to 755.0 thousand from 1.7 million at the beginning of the month, which is the lowest value in several months. Investors are wary of strong fluctuations and prefer to remain without positions until the situation becomes clearer.

Support and resistance

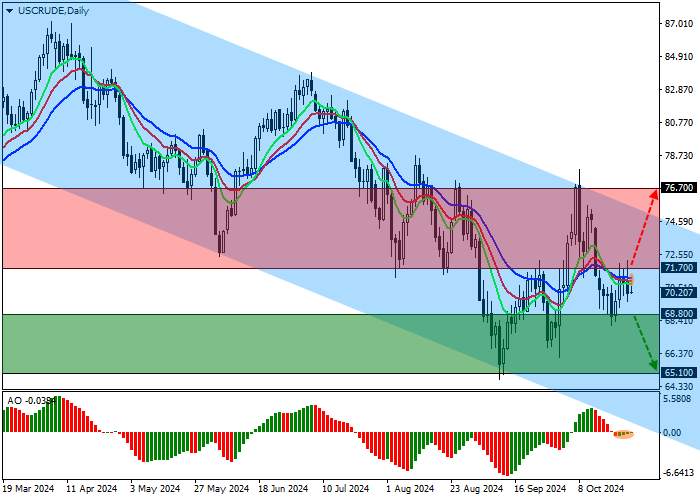

On the daily chart, the price is falling within the next wave inside a wide descending channel with dynamic boundaries of 74.60–62.00.

Technical indicators reinforce the relatively new sell signal: fast EMAs on the Alligator indicator again move away from the signal line, expanding the range of fluctuations, and the AO histogram forms new correction bars, again falling into the sales zone.

Support levels: 68.80, 65.10.

Resistance levels: 71.70, 76.70.

Trading tips

If the decline continues and the price consolidates below the support level of 68.80, it is relevant to open sell positions with a target of 65.10. Stop-loss — 70.00. Implementation time: 7 days and more.

If the asset continues to grow, as well as the price consolidates above the resistance level of 71.70, long positions with a target of 76.70 will be relevant. Stop-loss — 70.00.

Tải thất bại ()