Current trend

The USD/CHF pair has been trading near the 0.8650 mark for the seventh day, which indicates that large market participants have accumulated positions before a further impulse.

Since the beginning of October, the positive dynamics have been due to the American dollar strengthening under the influence of the labor market data. The September nonfarm payrolls amounted to 254.0K, exceeding the forecast of 147.0K by 1.7 times, and the previous value was corrected from 142.0K to 159.0K, and unemployment decreased from 4.2% to 4.1%.

The franc is under pressure from declining inflation, which in October amounted to 0.8% YoY, below the forecast of 1.1% and the previous value of 1.1%. Because of this, at the meeting on December 12, officials of the Swiss National Bank (SNB) may leave the interest rate at 1.00% or reduce it.

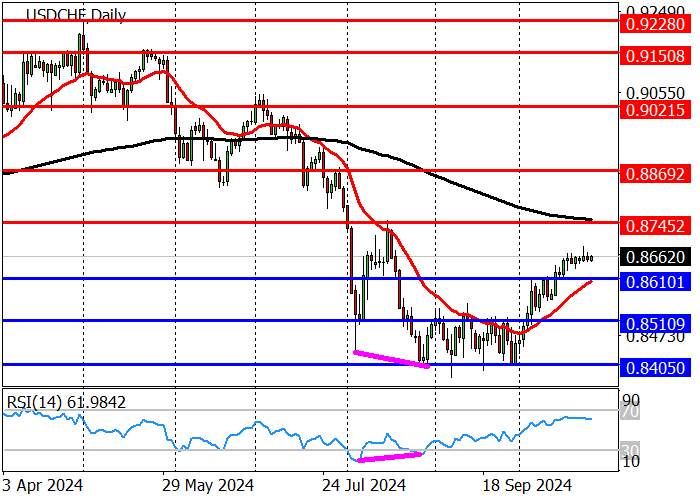

At the beginning of October, the quotes reversed into a long-term upward trend, consolidated above the resistance level of 0.8625 and heading towards 0.8745 and 0.8870. After adjusting to the nearest support level of 0.8610, long positions, with the target at 0.8745 are relevant. In case of a breakdown, the downward dynamics will reach the area of 0.8510. The RSI indicator (14) is growing and approaching the overbought zone but does not enter it, which allows for considering long positions along the trend.

Last week, the medium-term trend reversed upwards, and the quotes broke the target zone of 0.8634–0.8611 and headed to zone 2 (0.8921–0.8892). In case of correction to the support area of 0.8417–0.8391, long positions with the target at the weekly high of 0.8685 are relevant.

Support and resistance

Resistance levels: 0.8745, 0.8870, 0.9020.

Support levels: 0.8610, 0.8510, 0.8405.

Trading tips

Long positions may be opened from 0.8610, with the target at 0.8745 and stop loss 0.8570. Implementation period: 9–12 days.

Short positions may be opened below 0.8510, with the target at 0.8405 and stop loss 0.8540.

Tải thất bại ()