Current trend

Prices for benchmark Brent Crude Oil are correcting in a local downtrend, trading just below 71.00, decreasing amid a significant easing of geopolitical tensions in the Middle East. During Israel’s recent retaliatory actions against Iranian military facilities, oil infrastructure was not affected. Experts believe that official Jerusalem was under the influence of the US authorities, who warned it against massive attacks before the US presidential elections.

In addition, the asset is under pressure from oil reserves data. According to preliminary estimates, the American Petroleum Institute (API) report will reflect a change from 1.643M barrels to 0.600M barrels, and the Energy Information Administration of the US Department of Energy (EIA) report will record an increase from 5.474M barrels.

Meanwhile, according to the Chicago Mercantile Exchange (CME Group), trading volumes in oil contracts increased from 0.750M to 1.300M per day. Given the current dynamics, most of it is sell transactions, negatively affecting oil prices.

Support and resistance

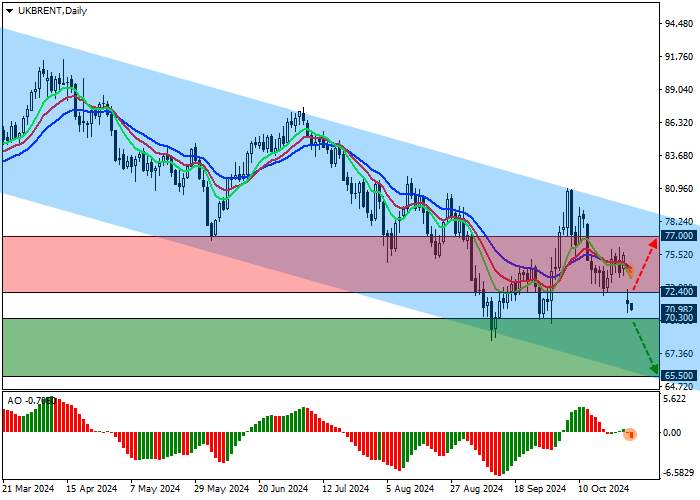

On the daily chart, the trading instrument is moving within the correction channel 78.50–65.50, falling to its support line.

Technical indicators have given a sell signal: fast EMAs of the Alligator indicator have crossed the signal line downwards, and the AO histogram has formed several downward bars in the sell zone.

Resistance levels: 72.40, 77.00.

Support levels: 70.30, 65.50.

Trading tips

Short positions may be opened after the price declines and consolidates below 70.30, with the target at 65.50. Stop loss is 72.00. Implementation period: 7 days or more.

Long positions may be opened after the price grows and consolidates above 72.40, with the target at 77.00. Stop loss is 70.00.

Tải thất bại ()