Current trend

The USD/JPY pair is moving away from the high of 153.85 after the Bank of Japan’s decision on the interest rate and before the presidential election in the United States.

The regulator’s officials, as expected, kept the interest rate unchanged at 0.25%. During the subsequent press conference, they noted that the main risk for the national economy was the inflation rate, and they might increase the interest rate if the situation develops according to the department’s specialists’ forecasts. The statements supported the yen, and the USD/JPY pair is preparing to return below the resistance level of 151.90.

The October labor market report puts pressure on the American dollar. Nonfarm payrolls fell from 223.0K to 12.0K compared to the forecast of 113.0K, and unemployment remained at 4.1%, justifying preliminary estimates. However, experts considered that the statistics were affected by two hurricanes in the country and a protest action by employees of The Boeing Co. However, investors will focus on the available information before the November data is available. Tomorrow, the US presidential election will take place. Earlier, the markets counted on the victory of the Republican candidate, Donald Trump, which supported the national currency. However, according to the latest polls, the chances of Trump and the representative of the Democratic Party, Kamala Harris’ chances have become equal.

Support and resistance

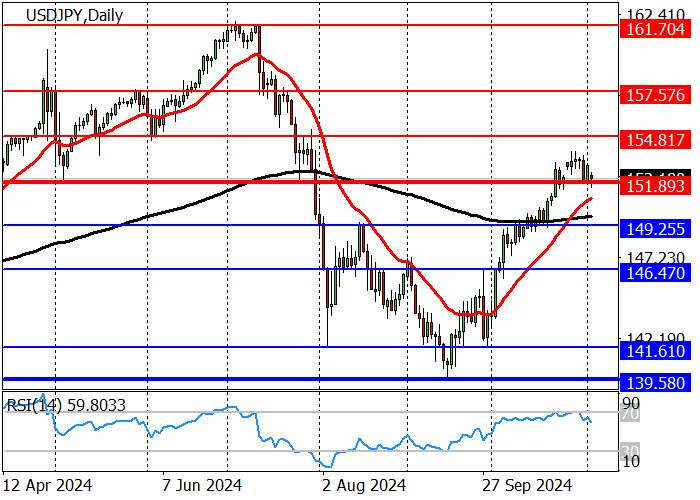

The long-term trend is downward. After reaching a low of 139.60 in September, the trading instrument went into an upward correction. Within it, the price broke the resistance level of 151.90. If the growth continues, it may reach the next resistance level of 154.80. If the price returns below 151.90, short positions with the targets of 149.25 and 146.47 are relevant.

The medium-term trend is upward. Last week, the quotes consolidated above zone 2 (151.68–151.04) and headed towards zone 3 (158.61–157.91). There, a correction began in the trend support area of 147.35–146.74. After reaching, it is worth opening long positions with the target at the October high of 153.86.

Resistance levels: 151.90, 154.80, 157.57.

Support levels: 149.25, 146.47, 141.61.

Trading tips

Short positions may be opened below 151.45, with the target at 149.25 and stop loss 152.44. Implementation period: 9–12 days.

Long positions may be opened above 154.25, with the target at 157.57 and stop loss 152.85.

Tải thất bại ()