Current trend

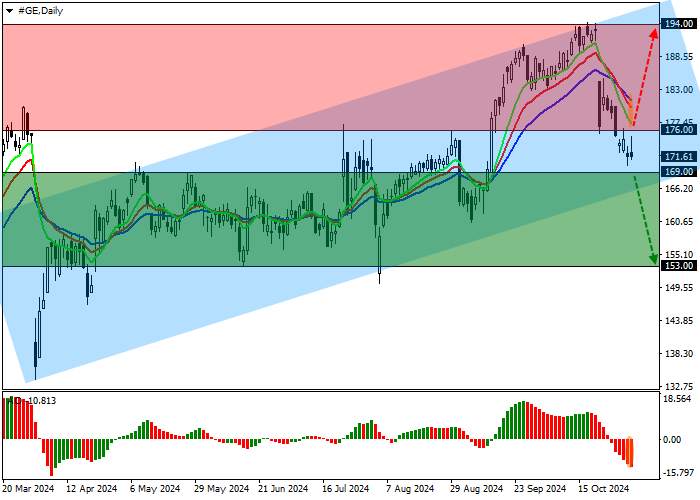

The quotes of the American diversified corporation General Electric Co. are in an uptrend just above the 171.0 mark.

The experts of Wells Fargo & Co. banking holding confirmed the rating of the emitter's shares at the "Overweight" level and raised the target price from 205.0 dollars to 210.0 dollars per paper. Analysts note that despite supply chain problems and a 4.0% decline in aircraft engine sales, in the third quarter General Electric Co. increased the number of orders by 29.0% and revenue from services in the commercial engine segment by 10.0%. In addition, the company has allocated 1.0 billion dollars for the development of its maintenance enterprises.

According to the emitter's financial report for the third quarter, the number of orders increased by 28.9%, revenue grew by 6.0% to 8.94 billion dollars, and operating profit — by 14.0%. Adjusted earnings per share (EPS) increased by 25.0% to 1.15 dollars versus 0.82 dollars a year earlier. In addition, General Electric Co. generated free cash flow of 1.8 billion dollars, which increased the forecast for annual operating profit to 6.7–6.9 billion dollars.

Support and resistance

On the D1 chart, the asset is declining and is still within the ascending channel with the boundaries of 196.00–168.00.

The technical indicators have reversed around again and have already issued a new sell signal: the fast EMAs of the Alligator indicator crossed the signal line from top to bottom, and the AO histogram, moving into the sales zone, forms new descending bars.

Support levels: 169.00, 153.00.

Resistance levels: 176.00, 194.00.

Trading tips

In case of a reversal and continuation of the local decline of the asset, as well as price consolidation below the support level of 169.00, one can open short positions with a target of 153.00 and a stop-loss of 176.00. Implementation period: 7 days and more.

If the asset continues to grow and the price consolidates above the resistance level of 176.00, one may open long positions with a target of 194.00 and a stop-loss of 170.00.

Tải thất bại ()