| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendations | BUY |

| Entry point | 1.4085 |

| Take Profit | 1.4160, 1.4282, 1.4404 |

| Stop Loss | 1.4020 |

| Key levels | 1.3549, 1.3671, 1.3916, 1.4160, 1.4282, 1.4404 |

| Alternative scenario | |

|---|---|

| Recommendations | SELL STOP |

| Entry point | 1.3915 |

| Take Profit | 1.3671, 1.3549 |

| Stop Loss | 1.4000 |

| Key levels | 1.3549, 1.3671, 1.3916, 1.4160, 1.4282, 1.4404 |

Current dynamics

USD/CAD strengthened for a second month in a row, trading near four-year highs at 1.4100, supported by a more cautious approach by US Federal Reserve officials to further monetary easing.

The regulator fears that after Donald Trump returns to the White House, disinflationary processes will slow down, since if the election program is implemented, the policy of reducing taxes and introducing additional duties on imported goods, consumer prices will begin to grow, which will need to be contained, and in these conditions, a significant reduction in the cost of borrowing looks inappropriate. However, there is no consensus among officials regarding further steps: last week, the head of the department Jerome Powell directly stated that "the economy is not giving signals about the need to rush to reduce interest rates", and the chair of the Federal Reserve Bank (FRB) of Boston Susan Collins noted that a December adjustment in the cost of borrowing by -25 basis points is possible, but will depend on incoming data. On the other hand, Chicago Fed President Austan Goolsbee hinted in an interview with Bloomberg TV that he expects another easing of monetary policy before the end of the year: such uncertainty regarding the further actions of financial authorities supports the American currency.

The Canadian dollar is under pressure due to the possibility that the new US administration will introduce 10.0-20.0% taxes on goods imported into the US, which could cause significant damage to Canadian exports, 75.0% of which are sold there, and in these conditions the Bank of Canada will be forced to continue cutting interest rates in order to prevent a recession.

Support and resistance levels

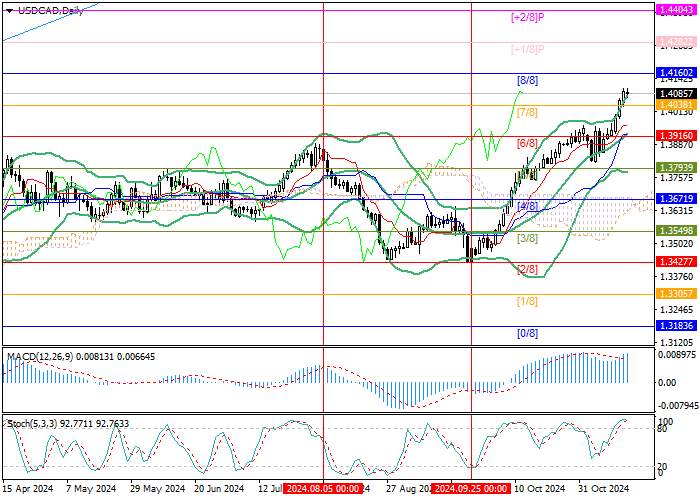

The trading instrument has consolidated above 1.4038 (Murray level [7/8]) and may grow to targets of 1.4160 (Murray level [8/8]), 1.4282 (Murray level [ 1/8]) and 1.4404 (Murray level [ 2/8]). In case of breaking through the middle line of Bollinger Bands 1.3916 (Murray level [6/8]), a decline to the area of 1.3671 (Murray level [4/8]), 1.3549 (Murray level [3/8]) is likely.

Technical indicators maintain a buy signal: Bollinger Bands and Stochastic are pointing upward, and the MACD histogram is increasing in the positive zone.

Resistance levels: 1.4160, 1.4282, 1.4404.

Support levels: 1.3916, 1.3671, 1.3549.

Trading scenarios

Long positions can be opened from the current level with targets at 1.4160, 1.4282, 1.4404 and stop loss at 1.4020. Implementation period: 5–7 days.

Short positions can be opened below the level of 1.3916 with targets at 1.3671, 1.3549 and stop loss at 1.4000.

风险提示:以上内容仅代表作者或嘉宾的观点,不代表 FOLLOWME 的任何观点及立场,且不代表 FOLLOWME 同意其说法或描述,也不构成任何投资建议。对于访问者根据 FOLLOWME 社区提供的信息所做出的一切行为,除非另有明确的书面承诺文件,否则本社区不承担任何形式的责任。

FOLLOWME 交易社区网址: www.followme.asia

加载失败()