Current dynamics

Shares of Meta Platforms Inc. are trading in a corrective trend around 553.00.

The stock is falling after the European Commission fined Facebook Marketplace €797.72 million for violating EU antitrust laws. Officials said the marketplace was illegally linked to Facebook, thereby imposing unfair trading conditions on other online ad providers. The case has been ongoing for more than two years, and during that time, the company's profit from the move far outweighs the fine. Meta Platforms Inc. also said it plans to appeal the European Commission's decision to ensure that its new projects are not blocked.

Meta Platforms Inc.'s third-quarter financial report showed revenue of $40.59 billion, up from $39.07 billion in the prior-year period and surpassing $34.15 billion last year. Earnings per share (EPS) increased from $5.16 to a record $6.03, up from $4.39 last year.

Support and resistance levels

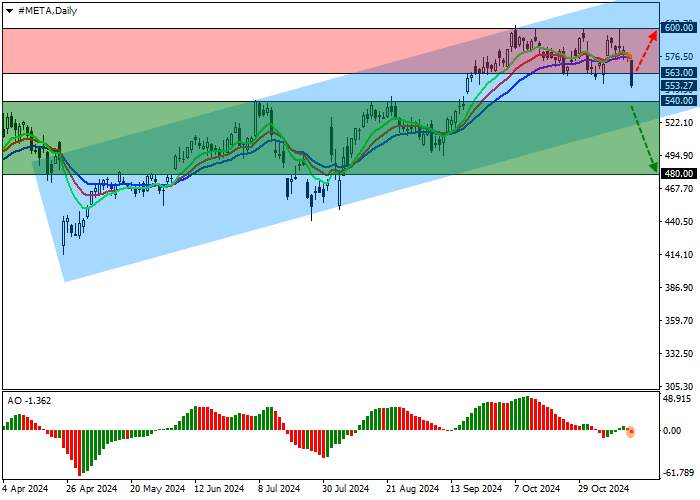

On the daily chart, the price continues to move in an upward trend, holding just below the channel resistance line with boundaries of 640.00–530.00.

Technical indicators have once again started to strengthen the sell signal that was received at the end of last week: the fast EMA of the Alligator indicator crossed the signal line from top to bottom, and the AO histogram, being in the sell zone, is forming downward bars.

Support levels: 540.00, 480.00.

Resistance levels: 563.00, 600.00.

Trading scenarios

In case of continuation of the downward movement, as well as consolidation of the price below the support level of 540.00, it is relevant to open positions for sale with a target of 480.00 and a stop-loss of 560.00. Implementation period: 7 days or more.

In case of continued growth and consolidation of the price above the resistance level of 563.00, positions for purchase with the target of 600.00 will be relevant. Stop-loss — 550.00.

Tải thất bại ()