Current dynamics

During the morning session, the USD/TRY pair is trading at 34.5047 amid weak macroeconomic statistics from Turkey and a strengthening US dollar.

Thus, in November, the consumer confidence index fell from 80.6 points to 79.8 points for the first time since June, but the indicator has been in the “red” zone below 100.0 points for more than five years. In the third quarter, the area of buildings for which permits were issued for construction decreased by 18.9%, the number of permits for the construction of real estate - by 18.8%, and for apartments - by 17.0%, reflecting the negative trend in the sector.

In turn, the US dollar reached 107.00 in USDX yesterday as a result of positive data from the labor market: the number of initial applications for unemployment benefits amounted to 213.0 thousand, below 219.0 thousand a week earlier and forecasts of 220.0 thousand, as a result of which the average number of applications over the past four weeks decreased from 221.50 thousand to 217.75 thousand, and the total increased slightly from 1.872 million to 1.908 million.

Given the weak potential for recovery in the Turkish economy, the likelihood of the lira strengthening is minimal, and the trend towards strengthening of the USD/TRY pair will continue.

Support and resistance levels

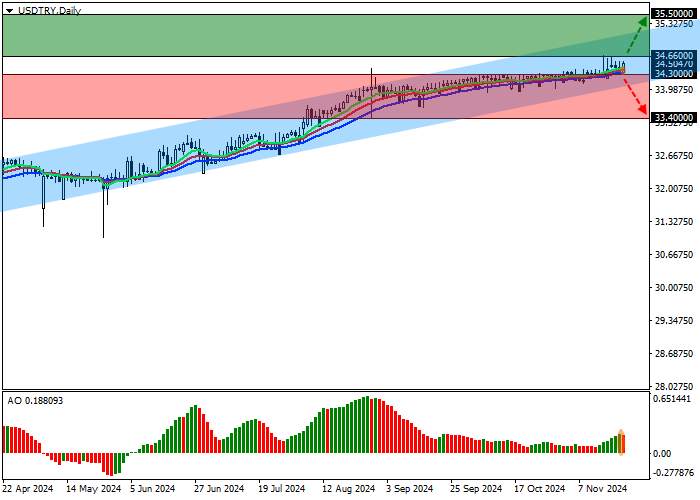

On the daily chart, an uptrend is forming and the trading instrument is moving above the key level of 34.3000 with a target at the trend resistance line of 35.5000.

Technical indicators strengthen the buy signal: the EMA oscillation range on the Alligator indicator expands upwards, and the AO histogram forms correction bars in the buy zone.

Resistance levels: 34.6600, 35.5000.

Support levels: 34.3000, 33.4000.

Trading scenarios

Long positions can be opened after the price rises and consolidates above 34.6600 with a target of 35.5000. Stop loss is 34.2000. Implementation period: 7 days or more.

Short positions can be opened after the price declines and consolidates below 34.3000 with a target of 33.4000. Stop loss is 34.6000.

Tải thất bại ()