| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendations | BUY STOP |

| Entry point | 0.5885 |

| Take Profit | 0.5950 |

| Stop Loss | 0.5858 |

| Key levels | 0.5720, 0.5750, 0.5800, 0.5830, 0.5858, 0.5885, 0.5920, 0.5950 |

| Alternative scenario | |

|---|---|

| Recommendations | SELL STOP |

| Entry point | 0.5830 |

| Take Profit | 0.5750 |

| Stop Loss | 0.5858 |

| Key levels | 0.5720, 0.5750, 0.5800, 0.5830, 0.5858, 0.5885, 0.5920, 0.5950 |

Current dynamics

The NZD/USD pair is holding near the 0.5850 mark during the Asian session: trading opened with a small positive gap after a confident downward trend at the end of last week, but the activity of the bulls is gradually decreasing, since there are no drivers for the recovery of the New Zealand dollar’s positions. The instrument fell to a one-year low last week, as the Reserve Bank of New Zealand’s (RBNZ) concerns about the national economic recovery and the impact of trade tariffs announced by US President-elect Donald Trump on exports only confirmed these fears. Against this background, market experts expect a reduction in borrowing costs by 50 basis points from 4.75% to 4.25%, while Westpac Banking Corp.’s baseline scenario assumes a correction of the New Zealand dollar by $0.58 by the end of the year with an “extremely low target” of $0.55 this year or in the first quarter.

In addition, New Zealand's macroeconomic statistics released on Monday showed exports in October rising from $5.01 billion to $5.77 billion, while imports rose from $7.06 billion to $7.31 billion, leading to a slight narrowing of the trade deficit from -$9.15 billion to -$8.96 billion. Retail sales in the country fell by 0.1% in the third quarter after -1.2% in the previous period, while retail sales excluding cars fell by 0.8% after -1.0%.

Tomorrow at 21:00 (GMT 2) the US Federal Open Market Committee (FOMC) will release its November minutes, with investors hoping to catch hints of a possible 25 basis point interest rate cut in December. On Wednesday, the market will receive a block of statistics on the dynamics of gross domestic product (GDP) for the third quarter, as well as on the personal consumption expenditure price index, the key inflation indicator for the US Fed.

Support and resistance levels

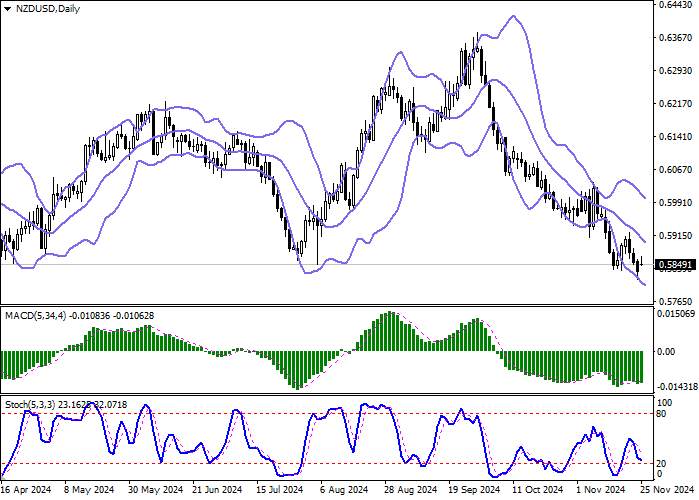

Bollinger Bands on the daily chart show a confident decline: the price range changes insignificantly, but remains quite spacious for the current level of activity on the market. MACD is trying to turn into an ascending plane, holding the previous sell signal (the histogram is below the signal line). Stochastic maintains a confident downward direction, but is located in close proximity to the minimum values, indicating the risks of oversold New Zealand dollar in the ultra-short term.

Resistance levels: 0.5858, 0.5885, 0.5920, 0.5950.

Support levels: 0.5830, 0.5800, 0.5750, 0.5720.

Trading scenarios

Long positions can be opened after a confident breakout of the 0.5885 level upwards with a target of 0.5950. Stop loss is 0.5858. Implementation period: 2-3 days.

The return of the bearish dynamics to the market with a subsequent breakout of the 0.5830 mark downwards may become a signal to open new short positions with a target of 0.5750. Stop loss is 0.5858.

Tuyên bố miễn trừ trách nhiệm: Quan điểm được trình bày hoàn toàn là của tác giả và không đại diện cho quan điểm chính thức của Followme. Followme không chịu trách nhiệm về tính chính xác, đầy đủ hoặc độ tin cậy của thông tin được cung cấp và không chịu trách nhiệm cho bất kỳ hành động nào được thực hiện dựa trên nội dung, trừ khi được nêu rõ bằng văn bản.

Tải thất bại ()