Current dynamics

During the Asian session, the USD/CHF pair quotes are holding in the region of 0.8856: the franc maintains a fairly confident position even against the backdrop of a significant increase in the US dollar, as it is supported by strong macroeconomic statistics.

Thus, according to the Swiss Federal Statistical Office (BfS), in the third quarter, total employment excluding agriculture increased by 1.2% year-on-year and by 0.2% quarter-on-quarter. Companies reported a 12.4% reduction in the number of open positions, which reflects the high level of their occupancy and the likelihood of growth in the volume of gross domestic product (GDP) in the fourth quarter.

The US dollar is trading at 106.70 in USDX today, slightly below yesterday's highs, as investors were disappointed by housing market statistics: in October, new home sales fell by 17.3% from 738.0 thousand to 610.0 thousand, the minimum from November 2023, which was the fastest decline in the last two years. Positive data from the Conference Board helped to balance the situation: the consumer confidence index rose from 109.6 points to 111.7 points, still missing the preliminary estimates of 111.8 points.

Support and resistance levels

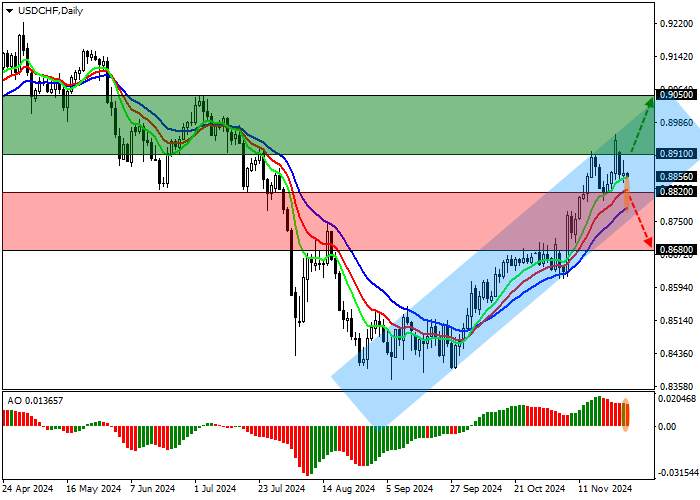

On the daily chart, the trading instrument is correcting, holding below the resistance line of the ascending channel 0.9000–0.8800.

Technical indicators strengthen the buy signal: fast EMAs on the Alligator indicator are moving away from the signal line, and the AO histogram is forming downward bars in the positive zone.

Resistance levels: 0.8910, 0.9050.

Support levels: 0.8820, 0.8680.

Trading scenarios

Long positions can be opened after the price grows and consolidates above 0.8910 with a target of 0.9050. Stop loss is around 0.8850. Implementation period: 7 days or more.

Short positions can be opened after the price declines and consolidates below the level of 0.8820 with the target of 0.8680. Stop loss is 0.8880.

Tải thất bại ()