Current dynamics

The USD/JPY pair is settling into a bearish trend at 151.64 amid a weakening US dollar and a higher probability of monetary policy tightening at the upcoming Bank of Japan meeting.

Tomorrow at 01:30 (GMT 2), data on the labor market and inflation will be released, which may be decisive for the regulator: according to preliminary estimates, unemployment will rise from 2.4% to 2.5%, and the Tokyo core consumer price index for November - from 1.8% to 2.0%, reaching the stability range of 1.0% to 2.0% set by the bank. Retail sales volumes for October will accelerate from 0.5% to 2.2%, and industrial production - from 1.6% to 3.9%. Analysts are trying to predict the likelihood of another increase in borrowing costs before the end of the year, and now about 60.0% of them are leaning towards this scenario. The key factor, however, will be the US Federal Reserve's decision in December: if US officials keep the indicator at the same level, the Bank of Japan is almost guaranteed to adjust the interest rate by 25 basis points.

The US dollar is falling, trading at 106.10 on the USDX, following the release of yesterday's economic data, which reflected a decline in gross domestic product (GDP) in the third quarter from 3.0% to 2.8% and a deflator from 2.5% to 1.9%. In addition, the number of initial applications for unemployment benefits decreased from 215,000 to 213,000, but the total number of applications increased from 1.898 million to 1.907 million. Among other things, the reference price index for personal spending is expected to increase in October from 2.7% to 2.8%, while the household income indicator changed from 0.3% to 0.6%, which is a positive signal, but may indirectly indicate increasing inflationary risks.

Support and resistance levels

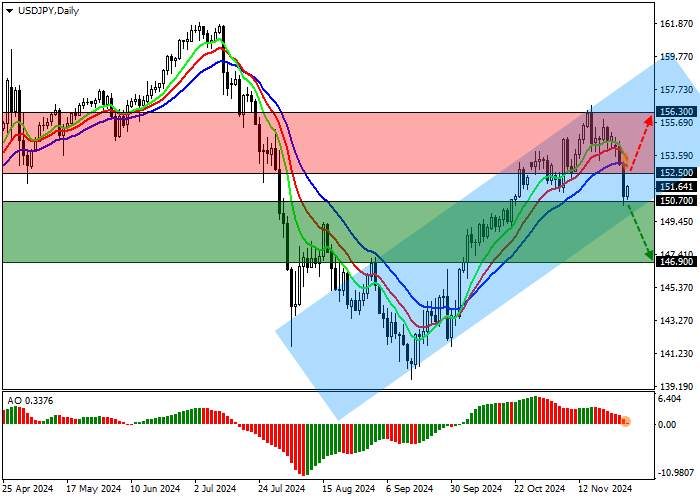

On the daily chart, the trading instrument is correcting within the trend, staying within the ascending channel 157.70–150.00.

Technical indicators weaken the buy signal: fast EMAs on the Alligator indicator are approaching the signal line, and the AO histogram is forming downward bars in the positive zone.

Resistance levels: 152.50, 156.30.

Support levels: 150.70, 146.90.

Business scenarios

Short positions can be opened after the price moves down and settles below 150.70 with the target at 146.90. Stop-loss — 152.00. Implementation period: 7 days or more.

Long positions should be opened after the price consolidates above the level of 152.50 with the target of 156.30. Stop-loss — 151.00.

Tải thất bại ()