Current dynamics

The AUD/USD pair is correcting in a sideways trend at the level of 0.6488 against the background of the weakening US dollar and the stable dynamics of the Australian currency.

According to the Australian Bureau of Statistics (ABS) report, in September, new private investment accelerated by 1.1% on a monthly basis and by 1.0% on an annual basis, and building construction costs rose by 1.1% due to a 1.1% increase in the price of equipment and machinery. On an annual basis, the fastest growing sectors are construction (33.3%), electricity and gas (10.9%) and transport (8.3%). The weighted average consumer price index reached 2.1% on an annual basis, with a forecast of 2.5% as a result of government subsidies for electricity and rent, but the benchmark indicator strengthened from 3.25% to 3.50%, remaining above the Reserve Bank of Australia (RBA) target range of 2.00% to 3.00%. Therefore, the probability of maintaining maximum interest rates is very high: experts are confident that officials will not begin to ease monetary policy before May.

The US dollar is holding at 106.10 on the USDX, retreating from last Friday's high of 108.10 under pressure from reports on the state of the economy and the labor market: in the third quarter, gross domestic product (GDP) slowed from 3.0% to 2.8% and the deflator from 2.5% to 1.9%. Personal household income adjusted in October from 0.3% to 0.6% and expenditures from 0.6% to 0.4%, above forecasts of 0.3%. The benchmark price index for personal spending changed from 2.7% to 2.8% and the broader indicator from 2.1% to 2.3%, meeting experts' expectations, prompting US Federal Reserve officials to refuse to cut interest rates by 25 basis points during the December meeting. The number of initial claims for unemployment benefits during the week decreased from 215,000 to 213,000, but the total number of claims increased from 1.898 million to 1.907 million.

Support and resistance levels

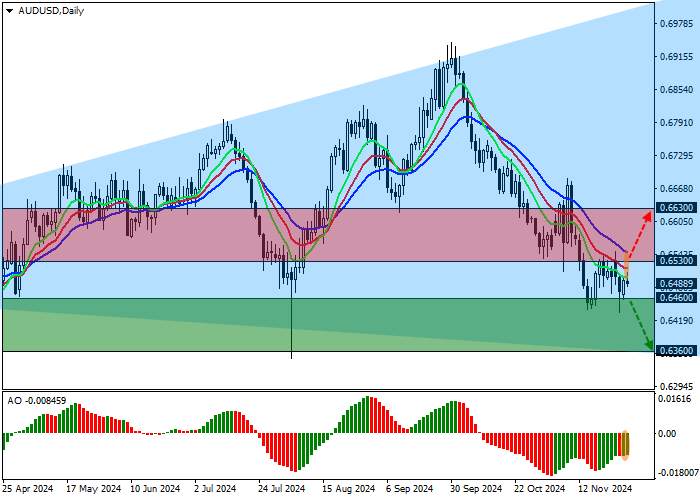

On the daily chart, the trading instrument is correcting above the support line of the "Expanding Formation" pattern with dynamic limits of 0.7000–0.6360.

Technical indicators slow down the sell signal: fast EMAs on the Alligator indicator point down, keeping a stable distance from the signal line, and the AO histogram is in the sell zone.

Resistance levels: 0.6530, 0.6630.

Support levels: 0.6460, 0.6360.

Business scenarios

Short positions can be opened after the price moves down and settles below the level of 0.6460 with the target of 0.6360. Stop-loss — 0.6510. Implementation period: 7 days or more.

Long positions can be opened after the price rises and consolidates above the level of 0.6530 with the target of 0.6630. Stop-loss — 0.6480.

Tải thất bại ()