| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendations | SELL STOP |

| Entry point | 922.00 |

| Take Profit | 887.40 |

| Stop Loss | 935.00 |

| Key levels | 887.40, 922.00, 957.50, 988.80 |

| Alternative scenario | |

|---|---|

| Recommendations | BUY STOP |

| Entry point | 957.50 |

| Take Profit | 988.80 |

| Stop Loss | 945.00 |

| Key levels | 887.40, 922.00, 957.50, 988.80 |

Current dynamics

After almost a month of downward dynamics, the XPT/USD pair quotes have entered a correction and are currently holding in the 940.00 region, and the new report from the World Platinum Investment Council (WPIC) for the third quarter failed to support the instrument's position.

According to the document, by the end of 2024, the metal supply deficit will reach 0.682 million ounces amid high demand from industrial enterprises, which in annual terms may amount to 7.269 million ounces compared to 7.951 million ounces in 2023. In the next reporting period, the deficit is expected to remain at the level of 0.539 million ounces, and the demand volume may reach 7.863 million ounces. Supply growth in the third quarter amounted to 7.0% compared to the same period a year earlier, recorded at around 1.479 thousand ounces due to an increase in warehouse stocks. For this and the beginning of 2025, a decrease in the indicator by 2.0% or 0.133 thousand ounces to 5.550 thousand ounces is predicted.

According to the latest report from the U.S. Commodity Futures Trading Commission (CFTC), the situation in real-money positions has changed significantly, with buyers again increasing their advantage, holding 39,111 thousand positions, while sellers now have 26,655 thousand trades. Over the past week, bulls have opened 2,866 thousand contracts, while bears have liquidated 2,075 thousand.

In these conditions, a continuation of the slow decline in quotes looks like the most likely scenario, but a sideways movement in the event of a drop in trading volumes cannot be completely ruled out.

Support and resistance levels

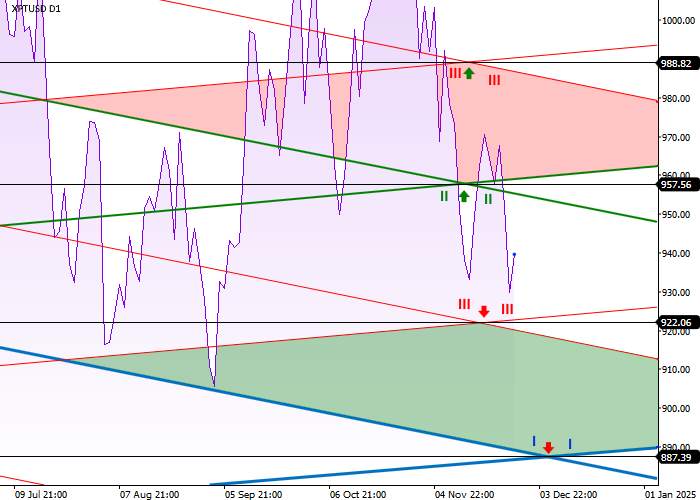

On the daily chart, the trading instrument is moving between the first-order levels (I), approaching the level of the left support of the first order (I) 890.00. The main scenario is a reversal and decline within the downtrend, where the cross of the right support of the third order (III) and the left support of the third order (III) 922.00 will become the nearest target, and the cross between the left support of the first order (I) and the right support of the first order (I) 887.40 - the long-term one.

If growth continues, it is likely that the price will approach the crossroad of the left resistance of the second order (II) and the right resistance of the second order (II) at 957.50, after which the quotes may reach the crossroad of the right resistance of the third order (III) and the left resistance of the third order (III) at 988.80.

Resistance levels: 957.50, 988.80.

Support levels: 922.00, 887.40.

Trading scenarios

Short positions can be opened after the price is fixed below 922.00 with a target of 887.40. Stop loss is around 935.00. Implementation period: 7 days or more.

Long positions can be opened after the price consolidates above 957.50 with a target of 988.80. Stop loss is around 945.00.

Tuyên bố miễn trừ trách nhiệm: Quan điểm được trình bày hoàn toàn là của tác giả và không đại diện cho quan điểm chính thức của Followme. Followme không chịu trách nhiệm về tính chính xác, đầy đủ hoặc độ tin cậy của thông tin được cung cấp và không chịu trách nhiệm cho bất kỳ hành động nào được thực hiện dựa trên nội dung, trừ khi được nêu rõ bằng văn bản.

Tải thất bại ()