Gold prices gained more than 1% on Thursday after Fed Chair Powell's cautious remarks on economy. The US trade deficit widened to a record high in March as businesses boosted imports of goods.

He knocked down any notion of taking pre-emptive rate cuts as inflation is still running above target, saying the tariffs implemented last month were "substantially larger than anticipated in the forecasts."

Treasury Secretary Scott Bessent and US Trade Representative Jamieson Greer are scheduled to meet with Chinese counterparts in Switzerland this weekend. But the negotiation will likely be tough.

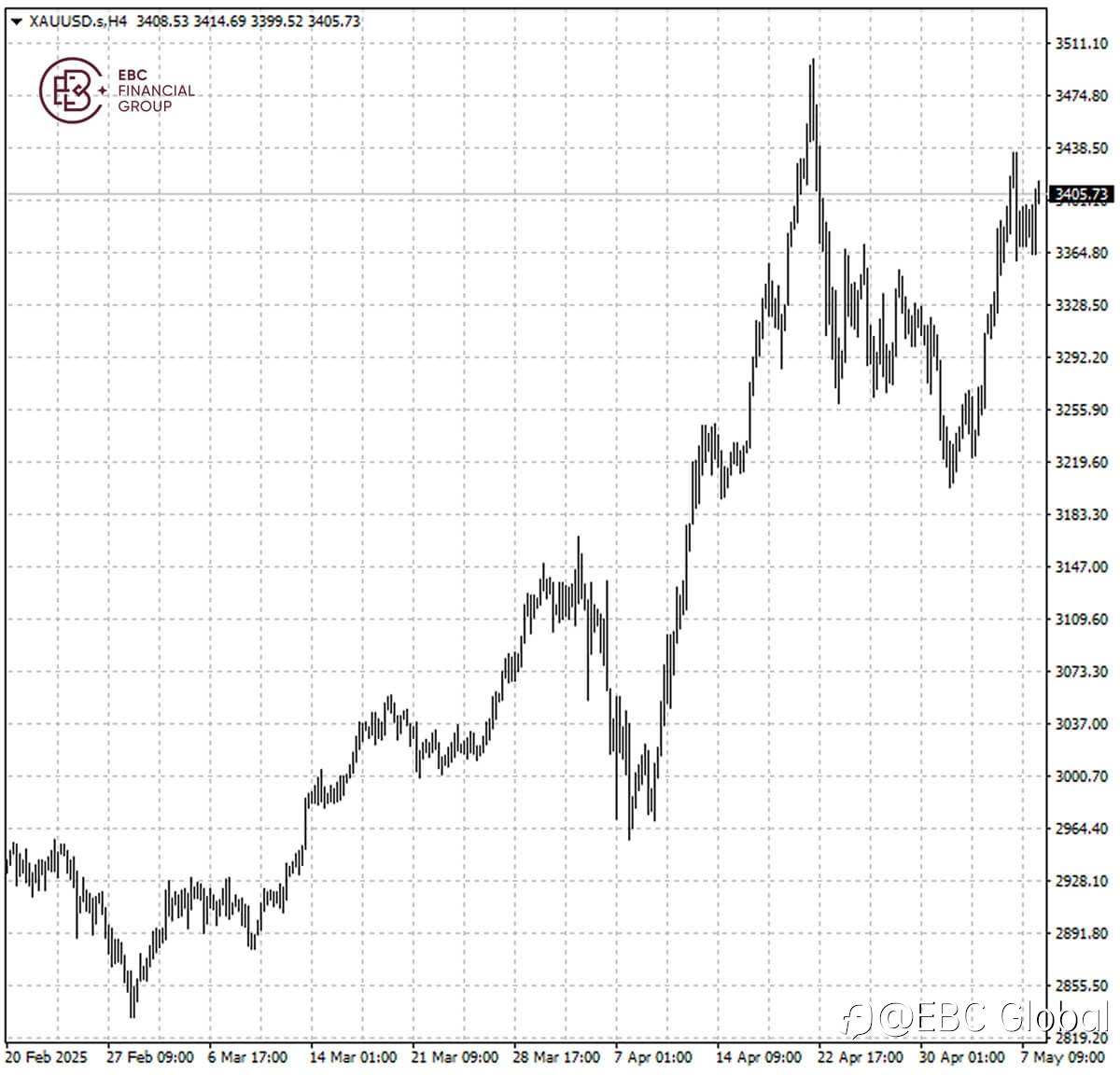

The metal has been one of the best-performing assets since US presidential election late last year, with many other popular "Trump trades" such as the dollar making big early gains before reversing course.

Total global demand for gold climbed to 1,206 tonnes during the first quarter of the year, up 1% compared with the same period a year prior, according to the WGC quarterly report.

The local price premium for gold in China briefly rose to $100 per troy ounce above the international benchmark weeks ago. The buying frenzy even prompted the Shanghai Gold Exchange to issue warnings.

Bullion's move is reminiscent of range trading in late April, so we expect it to decline towards support around $3,360 in the short term before bouncing back.

EBC Wealth Management Expertise Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Group Corporate News or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Tuyên bố miễn trừ trách nhiệm: Nội dung trên chỉ thể hiện quan điểm của tác giả hoặc khách mời. Nó không đại diện cho bất kỳ quan điểm hoặc vị trí nào của FOLLOWME và không có nghĩa là FOLLOWME đồng ý với tuyên bố hoặc mô tả của nó, cũng không cấu thành bất kỳ lời khuyên đầu tư nào. Đối với tất cả các hành động do khách truy cập thực hiện dựa trên thông tin do cộng đồng FOLLOWME cung cấp, cộng đồng không chịu bất kỳ hình thức trách nhiệm pháp lý nào trừ khi được cam kết bằng văn bản.

Trang web cộng đồng giao dịch FOLLOWME: www.followme.asia

Tải thất bại ()