The Trump administration will revise a Biden-era rule that required the oil and gas industry to provide nearly $7 billion in new financial assurances to cover the cost of decommissioning old infrastructure.

The Interior Department said it would develop a new regulation, but did not give specifics. The move is the latest of measures to boost domestic energy production amid still-hot inflation.

Still some shale producers have recently said they would cut capital expenditure in response to sliding oil prices, prompting industry warnings that US production had peaked and could begin falling.

Diamondback Energy said it estimated the number of US fracking crews had already fallen by 15% this year and would continue to decline unless there was a rapid turnaround in prices.

At less than $60 a barrel, many US shale producers will struggle to turn a profit, especially in some of the country's ageing basins. That means OPEC+ and other major producers will likely steal their market share.

OPEC+ could bring back to the market as much as 2.2 million bpd by November, five OPEC+ sources said as the group's leader Saudi Arabia seeks to punish some fellow members for poor compliance.

WTI crude shot up on Tuesday amid signs of more Europe and China demand, but it remains below $60. Ongoing nuclear talks between Iran and the West also cloud oil market outlook.

A tough year

This year is set to mark Big Oil's third consecutive 12-month period of falling profits. The adjusted net income of five of the biggest western oil companies fell by about $90bn from 2022 to 2024.

"We now expect global upstream development spend to fall year on year for the first time since 2020," Fraser McKay, at energy consultancy Wood Mackenzie, said in a recent report.

The whole industry is feeling the chill. Last month the three biggest western oil services companies, Baker Hughes, Halliburton and SLB, all raised concerns about the weakening outlook.

Exxon Mobil announced Q1 earnings that decreased from the same period last year but beat estimates. Benefiting from prolific production from its Guyana oilfield, it increased production by 20% year-over-year.

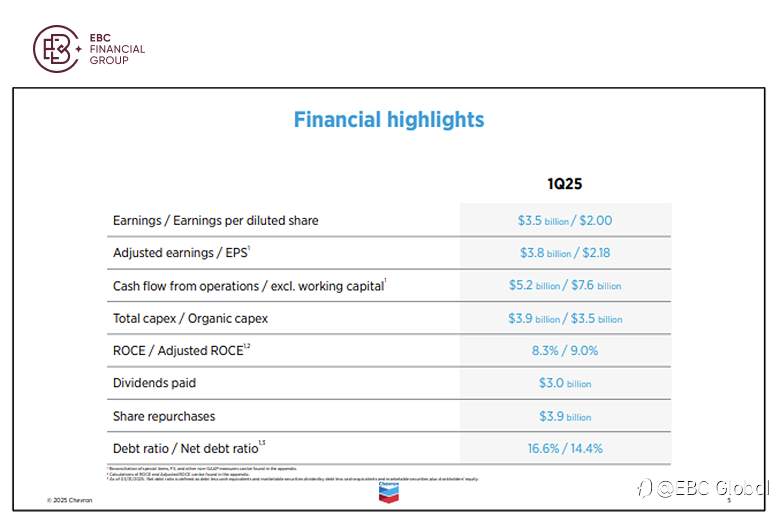

Chevron's financial results met expectations. Refining profit improved from the previous quarter, though earnings from energy production were down and downstream operations reported the first loss in four years.

Chevron's Q1 oil and gas production was flat compared to the previous year as growth in Kazakhstan and the Permian was offset by loss of production from asset sales.

The company is also set to defend its planned $53-billion acquisition of oil producer Hess, which would give it a crucial foothold in a prolific oilfield off the coast of Guyana.

Peer comparison

Big Oil have shown a clear split in how those companies are positioned to weather the downturn sparked by a slump in oil prices to a four-year low in April. The difference speaks to where each is in its business cycle.

Investors were focused on share repurchase cuts since lower oil prices would reduce free cash flow. Exxon repurchased $4.8 billion of shares during Q1, on track to meet its annual target of $20 billion.

Chevron said it would reduce buybacks to between $2 billion and $3.5 billion in the current quarter. If rolled forward, that would mean Chevron could land between $11.5 billion and $13 billion in repurchases for 2025.

With net-debt-to-capital ratio at 7%, Exxon was the only integrated oil company that did not increase net debt during Q1, said Kim Fustier, head of European oil and gas research at HSBC.

CEO Mike Wirth issued a stark warning about the firm's possible departure from Venezuela as a Biden-era license allowing the company to operate in the country is set to expire.

Earlier this year, the company announced it would lay off up to 20% of its staff as part of an effort to simplify the business and cut up to $3 billion in costs. All told, its shares could continue to underperform Exxon's.

Shale firms are more focused on capital discipline these years. Both companies saw their market cap soar to record peaks in 2022 due to global demand recovery following victory over Covid-19.

EBC Wealth Management Expertise Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Group Corporate News or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Tuyên bố miễn trừ trách nhiệm: Nội dung trên chỉ thể hiện quan điểm của tác giả hoặc khách mời. Nó không đại diện cho bất kỳ quan điểm hoặc vị trí nào của FOLLOWME và không có nghĩa là FOLLOWME đồng ý với tuyên bố hoặc mô tả của nó, cũng không cấu thành bất kỳ lời khuyên đầu tư nào. Đối với tất cả các hành động do khách truy cập thực hiện dựa trên thông tin do cộng đồng FOLLOWME cung cấp, cộng đồng không chịu bất kỳ hình thức trách nhiệm pháp lý nào trừ khi được cam kết bằng văn bản.

Trang web cộng đồng giao dịch FOLLOWME: www.followme.asia

Tải thất bại ()